Ontario Child Support: How It's Calculated & More

Child support ensures children of separated or divorced parents get the same financial support they'd have if their parents were together. At a minimum, it covers the children's basic needs like food, clothing and school supplies.

You must establish the children's paternity before applying for a parenting or support order. However, the court can order anyone found to be in loco parentis (in a parental role) to pay child support. Even if you don't have decision-making responsibility and parenting time, you could be obligated to pay support.

Ontario's child support guidelines

Government child support guidelines help determine the obligation of the payor (i.e., the parent who will pay). A judge can make adjustments based on the parent's ability to pay and the children's needs.

If you reach an agreement with the other parent, you don't have to follow the guidelines. But don't settle too far below the guideline amount if you want court approval for your agreement, which would legally obligate the payor to pay.

There was a time when divorced parents followed the federal child support guidelines and never-married parents followed Ontario guidelines. However, Ontario has since made its guidelines the same as the federal ones.

The following steps will help you estimate your support amount. To get an estimate instantly, plug your information into the calculator above.

Step 1: See who pays and whose income matters

When neither parent has more than 60% of parenting time, the higher-income parent pays child support. Otherwise, the parent who spends less time with the children pays.

In many cases, only the income of the parent with less time goes into the guideline calculation. In this case, you can set up child support online, in court or by written agreement.

However, when any of the following is true, both parents' incomes factor into the formula, and you can only set up child support in court or by written agreement:

- Neither parent has more than 60% of the parenting time.

- Only one is a biological parent.

- There are special or extraordinary expenses.

- Either parent claims undue hardship.

- The child is over 18.

As your parenting schedule affects how support is calculated, it's essential you get an accurate parenting time calculation.

Step 2: Figure out the number of eligible children

You can receive support on behalf of your children under 18 or dependents above that age who rely on you due to disability, illness or another reason like enrollment in university.

Step 3: Determine annual gross income

If both parents' incomes factor into the calculation in your situation, you need to determine each parent's annual gross income. If only one parent's income matters, just determine theirs.

You can find annual gross income by looking at line 1500 of a parent's income tax return or Notice of Assessment from the Canada Revenue Agency. Alternatively, you can plug income information into Worksheet 1 or agree on how much income the parent has.

Both parents must provide the court and other parent with proof of income (e.g., income tax returns, pay stubs).

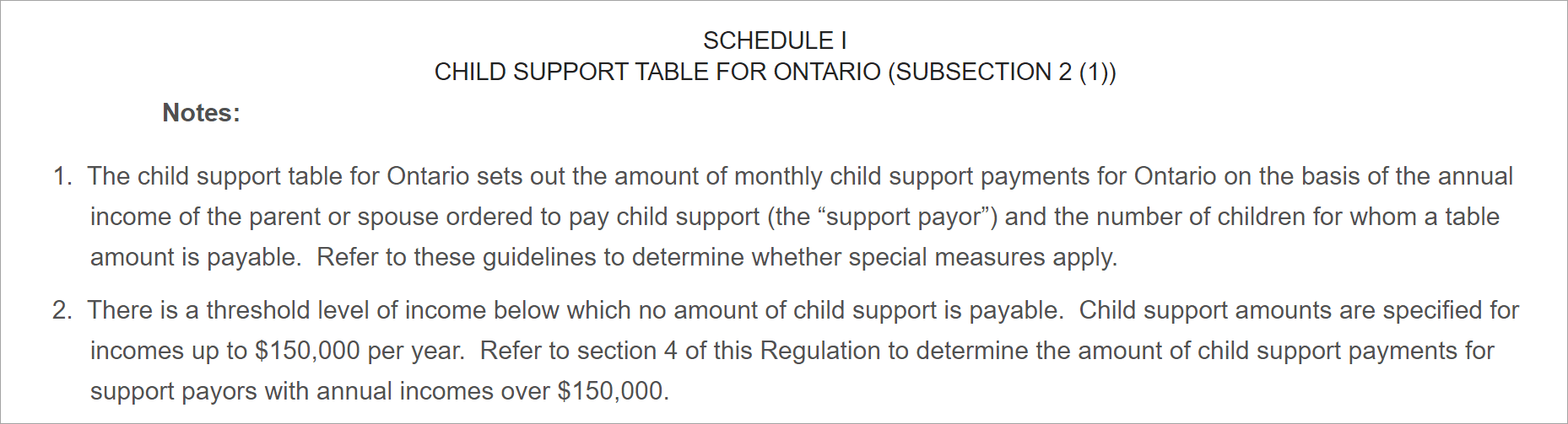

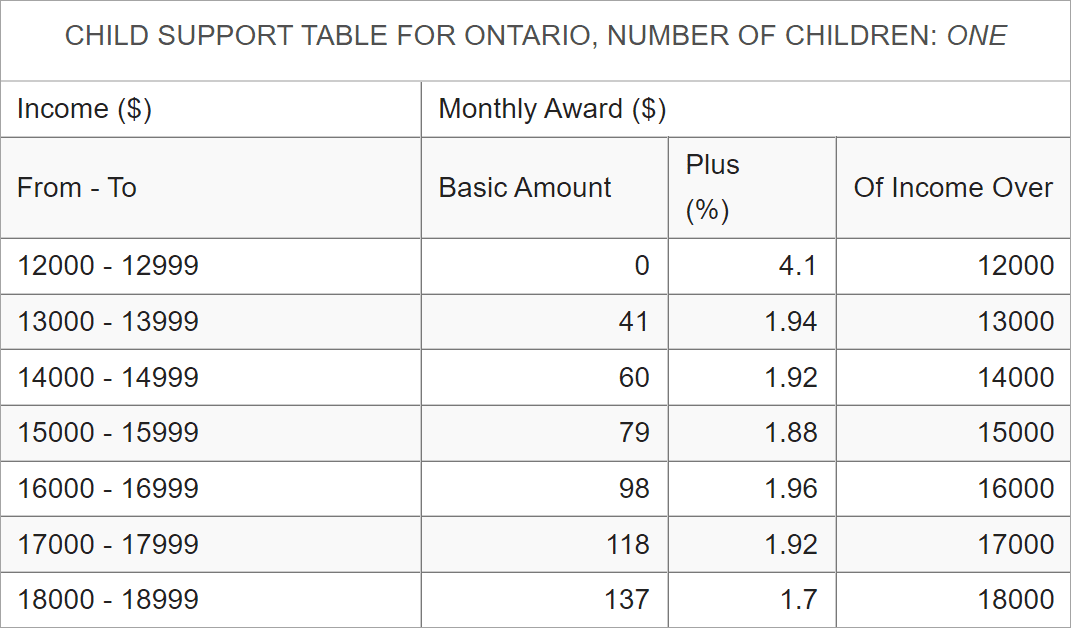

Step 4: Find the table that applies to your case

To determine a parent's basic obligation, you can use the tables the government publishes or its Child Support Lookup tool. The tool will consult the right table so you don't have to do the math. If you use the online tool, skip this step.

When both parents live in Ontario, use the tables listed under Schedule 1 in Ontario's support guidelines. Choose the table for your number of eligible children.

When one parent lives elsewhere in Canada, go by the table where the payor lives. You can find other tables on provincial and territorial government websites.

When one parent lives outside of Canada, use Ontario's table. However, in some cases the other country's laws might apply. It's best to get legal advice if you're in this situation.

Step 5: Determine the basic obligation

If you had to determine each parent's annual income above, find each parent's basic obligation as well. If you only had to determine one parent's income, find just that parent's basic obligation.

To use the online lookup tool, enter a parent's annual income, their province and the number of eligible children you have together. It will tell you the amount the government expects them to pay monthly, before any adjustments.

If you're using the table, find the parent's income in the first column. The third column only applies if their income is above the dollar amount listed in the fourth column.

Example: A parent with one child and an annual income of $18,500 would calculate 1.7% of $500 (the amount they make over $18,000). They would then add their result ($8.50) to the amount in the second column to get their basic obligation. In this case, the result is $145.50.

Step 6: Compare each parent's basic obligation

If one parent has more than 60% of parenting time, skip this step.

Otherwise, subtract the lower basic obligation from the higher one. The parent with the higher income pays the difference.

Example: Dharma and River have three children. Dharma has an annual income of $27,000, while River earns $33,000. According to the table for three children, Dharma would pay $559 and River would pay $680 in monthly child support. They subtract the lower obligation from the higher one to find that River must pay Dharma $121 ($680 minus $559) in monthly child support.

Note that this is the most common way to determine support in shared parenting situations. The court can deviate from this amount and even follow a different formula to determine the basic obligation.

Step 7: Add special or extraordinary expenses

Special or extraordinary expenses (also called Section 7 expenses) are costs the person requesting support can't cover on their own. These can include:

- Child care expenses

- Medical and dental insurance premiums for the children

- Extraordinary school expenses

- University expenses

- Extraordinary expenses for extracurriculars

If you're not requesting help with special expenses, you can skip this step. The result you got in your last step is your monthly payment according to the government guidelines.

If you're requesting help with special expenses, you must prove that the expenses are reasonable and in the children's best interest.

Generally, parents share these amounts in proportion to their income. For example, if the payor makes 70% of the combined parental income, they have to pay 70% of the special expenses. Parents can agree on a different way to split them.

Add the payor's share of these expenses to their basic obligation to get their guideline monthly payment.

Special circumstances

Payors with low incomes or hardships

If a parent's income is below the lowest amount shown in the relevant child support table, the court might rule that they do not have to pay child support.

A payor can claim undue hardship if they'll have financial difficulties paying child support. If approved, they may get a lower payment or no payment at all.

Circumstances that might qualify as undue hardship include:

- Unusually high debt

- Obligation to pay support for another child

- High costs to spend time with the children

To determine whether their situation qualifies for undue hardship, the court does a Household Standards of Living Test. Schedule II of the child support guidelines explains how this is done.

Imputed income

Imputed income is an amount the court attributes to a parent that differs from what the parent may actually earn. The court may do this if a parent:

- Is intentionally unemployed or underemployed

- Is exempt from paying federal or provincial income tax

- Has failed to provide income information when legally required to do so

Retroactive child support

Retroactive child support is an amount the payor owes from the time before there was a support order. This is usually limited to the past three years.

Before figuring out whether to allow retroactive child support, the court looks at:

- Why the application for support was delayed

- The payor's behaviour

- What the children's lives were like in the past and how they are now

- Whether ordering retroactive support would cause undue hardship to the payor

Split parenting time

In split parenting time, each parent has at least one of the children from their relationship for more than 60% of the year. It's an uncommon setup.

If you have split parenting time, you need to find the amount each parent would pay in child support for the children who do not spend the majority of time in their care. (If one parent lives in a different province or territory, use the child support table for each parent's respective location to find their basic obligation.)

Then subtract the lower basic obligation from the higher one. The parent with the higher basic payment pays the difference.

Example: Stevie and Gabriel have five children. Stevie, who has an annual income of $38,000, cares for three children for more than 60% of the year. Gabriel, who makes $40,000 a year, has two children in his care.

The child support table says Stevie's basic obligation for two children is $571 and Gabriel's is $805 for three children. $805 minus $571 is $234. Since his basic table amount is higher, Gabriel pays Stevie $234 in monthly child support, per the government guidelines.

(Note that in split parenting time, the parent with the higher income does not always pay. If Gabriel were the primary caretaker of three children instead of two, Stevie would owe him $173 in monthly child support.)

Paying child support

You won't pay support directly to the other parent but through the Family Responsibility Office (FRO). There are a few accepted payment methods:

- Preauthorized debit from your bank account

- Online bank transfer

- Cheque or money order

- Automatic deduction from your paycheque

The court will tell you in writing when to stop paying support. Parents who reach a support agreement can state when payments will end.

Enforcing child support

The FRO is in charge of enforcing child support payments.

If the court gives an order for support, it is automatically registered with the FRO. If you reach a support agreement outside of court, you'll need to register your agreement with the FRO in order for it to be enforceable.

Changing child support

There are two ways to change a child support order (or a support agreement you registered with the FRO).

If you agree with the other parent on the change, bring a motion to change on consent. In this case, you don't have to submit new financial statements and might not even have to appear in court.

To ask a judge to change support when you can't agree, you can motion to change child support. You must wait at least six months after the support order or agreement is made to do this.

Keeping track of payments and expenses

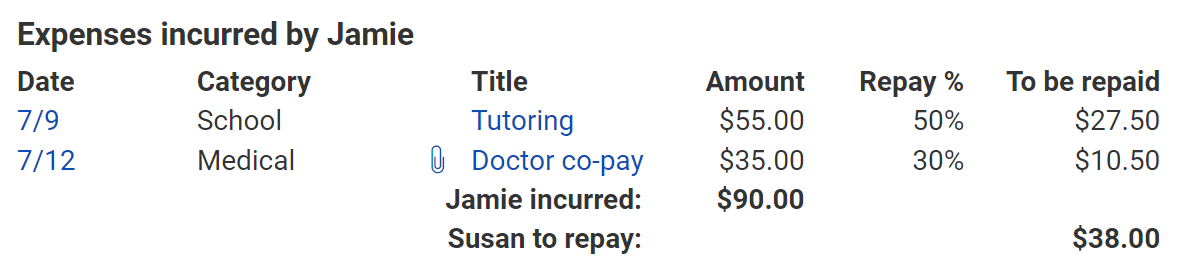

Whether you're paying or receiving child support, the Custody X Change app can help you keep track of support payments and child-related expenses.

Try this with Custody X Change.

Try this with Custody X Change.

Log details of every payment or expense into your parenting expense tracker to ensure you're on time and paid up.

When you're owed money for expenses, share an expense report with the other parent — either digitally or on paper. This is just one way Custody X Change makes co-parenting simpler.