Child Support in Saskatchewan

The law in Saskatchewan upholds that children of separated or divorced parents should receive a level of financial support equal to what they'd get if their parents were together.

Child support is paid by the parent who spends less time with the child — or who has the higher income if parents share parenting time. The parent who pays support is the payor. The parent who receives support is the recipient.

Estimating your child support amount

Canada's federal child support guideline includes a formula and rules for determining an appropriate support amount. The guideline applies whether parents agree on a support amount or the court decides the support amount. In both cases, a judge may approve an amount that differs from the guideline child support amount if a parent provides a good reason.

Use the calculator above to estimate how much support you will pay or receive under the federal child support guideline.

You can also use the Government of Canada's Child Support Lookup Tool, as long as one parent has more than 60% of parenting time.

Agreeing on a child support amount

You and the other parent can figure out an appropriate support amount together or try an alternative dispute resolution method led by a professional trained to help people agree.

You can use Saskatchewan's support agreement template (PDF download), write a support agreement yourselves, or have your ADR professional do it for you. This agreement is separate from your parenting plan.

A witness should be present when you and the other parent sign the agreement, and the witness should sign the document as well.

It's recommended you either register your agreement with the Maintenance Enforcement Office (more below) or have the court turn it into a consent order. Otherwise, your agreement won't be legally enforceable.

Child support is the right of the child. If you plan to register your agreement or turn it into a consent order, you cannot agree that neither parent will pay support or agree to an amount that is too low to cover the child's basic needs. The court may refuse to grant you a divorce or parenting order if your agreement strays too far from the guideline.

Use the guideline amount for your case as a guide when agreeing. If your amount differs, you'll have to explain why if you want the court to approve your agreement. Agreeing to the guideline amount has advantages over waiting for the court to award it; your case may move faster, and you can choose how to share special expenses.

Applying for child support

To request a support order, fill out a Petition (Word download). You can ask the court to decide your support amount or to incorporate the terms of your agreement in a consent order. Both parents must also fill out Financial Statements (Word download).

Paying child support

You can pay support to the Maintenance Enforcement Office (MEO), which will distribute the funds to the recipient, or you can pay support directly to the recipient. The latter is only an option if you choose not to register your order or agreement with the office. Registering with the MEO is recommended as the office will know right away if the payor misses a payment and can enforce the order.

Enforcing child support

You can register your court order or agreement with the MEO so you can address nonpayment through the office instead of communicating with the payor. Register with the MEO if you have any concerns that the other parent might not pay.

The payor cannot refuse to pay child support even if the recipient denies parenting time, and the recipient cannot deny parenting time even if the payor misses support payments.

Recalculating child support

As time passes, your child support amount may no longer be suitable. If this is the case, you can ask the court to recalculate child support. Make sure you meet the qualifications before applying.

Alternatively, parents can reach an agreement to modify the support order. If the original amount was court-ordered or court-approved, a judge will have to sign off on the new amount.

Keeping track of payments and expenses

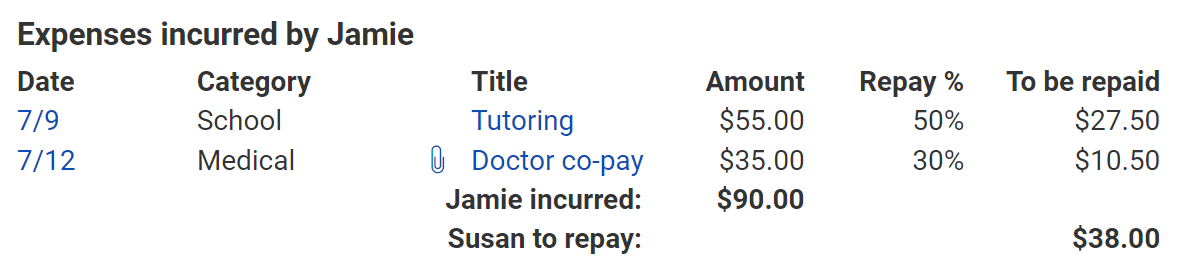

Whether you're paying or receiving child support, the Custody X Change app can help you keep track of support payments and child-related expenses.

Try this with Custody X Change.

Try this with Custody X Change.

Log details of every payment or expense into your parenting expense tracker to ensure you're on time and paid up.

When you're owed money for expenses, share an expense report with the other parent — either digitally or on paper. This is just one way Custody X Change makes co-parenting simpler.