Noncustodial Parent Claiming a Child on Taxes

In the United States, when parents are divorced or separated, one of them — and only one — may claim an exemption for the child on their taxes.

Generally, you can claim the exemption through the year your child turns 18, while they're in college, or throughout their life if they're disabled. The custodial parent may keep the exemption for themselves or grant it to the other parent.

Does a noncustodial parent have the right to claim their child on taxes?

Only if the custodial parent grants them this right. This is an IRS rule.

Both parents should talk to each other (through your lawyers, if you have to) to clarify who will take the tax exemption in a given year. As long as only one of you claims the exemption (and attaches the proper form to your tax return), the IRS is satisfied. The IRS won't let both of you take the tax exemption in the same year for the same child.

Who is the custodial parent according to the IRS?

According to the IRS definition, the custodial parent (for a given tax year) is the one who had more overnights with the child. If parents had exactly 50/50 parenting time, it's the higher-income parent (based on adjusted gross income).

Use the IRS definition for tax purposes. Consult your Custody X Change parenting time calculations if there's any doubt who had more overnights during the past year.

Don't base the designation of custodial parent on what's written in your divorce decree if it differs from who had more parenting time.

How does the IRS know who the custodial parent is?

It doesn't. Also, it doesn't really care, as long as you're not both claiming the role.

The custodial parent self-certifies their role when they file taxes.

The IRS says that the custodial parent's role is to decide which parent gets the exemption. There's no need to fight over it, as it's clear who should have this role. One of you has more parenting time (or, if equal time, more income), and that's all there is to it.

Be truthful. If you argue about this with the IRS, they'll figure it out for you, which will take longer and may be less pleasant.

Giving the noncustodial parent permission to claim your child

The custodial parent fills out the proper form and gives a copy to the noncustodial parent. (Learn about Form 8332.) The noncustodial parent files a copy of this form with their taxes for the following tax year.

If the noncustodial parent claims your child without permission

When the noncustodial parent claims the exemption on their taxes and they don't attach the required Form 8332 signed by the custodial parent, their tax filing doesn't comply with IRS rules. The IRS may enforce its rules.

If both of you are claiming an exemption for the same child (and you're aware of the disagreement), you can let the IRS decide who gets the exemption. However, this process is slow. The IRS e-filing system checks your child's Social Security number and won't let you e-file your taxes if someone else already claimed your child as a dependent. You'll have to file on paper instead.

As far as your local family court is concerned, anything you're required, allowed or forbidden to do is written into your divorce decree or separation agreement. Refer back to your decree to see if there's a provision like "who gets to claim child on taxes after divorce." A family court judge can't enforce your federal taxes the way an IRS agent can, but they can hold a parent in contempt of court for violating the court order.

Paying child support and claiming a child on taxes

Whether you pay or receive child support is unrelated to whether you're eligible to claim the exemption for your child.

Designating who can claim the child on taxes in your parenting plan

Designating who can claim the child on taxes in your parenting plan takes away any uncertainty.

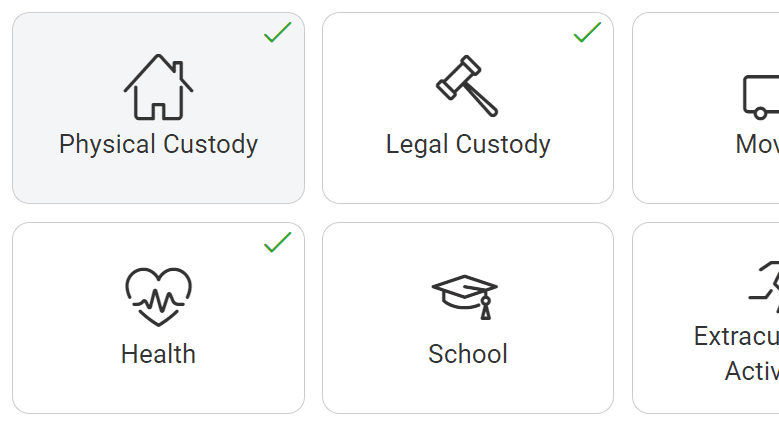

In the Custody X Change app, click the "parenting plan" tab. More than 25 categories of parenting provisions will appear.

Try this with Custody X Change.

Try this with Custody X Change.

Click the "taxes" category, then choose an option or write in your own.

Including a tax provision in your parenting plan will save you a lot of time and stress.