Child Support in New Brunswick

Child support evens out the financial responsibility parents have to provide for their children. The parent who receives support is called the beneficiary, while the parent who pays support is the payor.

Calculating child support

New Brunswick uses Canada's Federal Child Support Guideline to determine child support.

The child support amount is based on the number of children and the payor's income (or both parents' incomes if each parent has at least 40 percent of time in the parenting schedule).

The parent who spends less time with the child, the access parent, is responsible for monthly support payments. In cases where parents spend nearly equal time with the child, the parent with the higher income typically pays.

The parent must pay support even if they choose not to take part in the child's life. If someone is not the child's biological parent, such as a stepparent, they may owe support if there's proof they acted in a parental role.

Use the calculator above to estimate how much support the payor will owe. You can also use Canada's Child Support Lookup Tool or New Brunswick's Child Support Table if the beneficiary has more than 60 percent of parenting time.

Special expenses

Special expenses are child-related expenses not covered by child support. They include:

- Daycare fees

- Medical and dental insurance premiums

- Health care costs not covered by insurance that are greater than $100 annually

- Extracurriculars

- Extraordinary fees for education (e.g., tutoring)

- Postsecondary studies

Each parent is expected to contribute an amount proportional to their share of their combined incomes. For example, if the payor earns 80 percent of the combined income, they will pay 80 percent of the special expenses in addition to the child support amount.

Agreeing on child support

You can include the terms of your support arrangement in a parenting plan or draft a standalone separation agreement (also called a domestic contract).

If you want your agreement to become a court order, the agreed amount must be exactly the same as the guideline support amount. The court won't grant a divorce if your agreed amount does not match what the government calculates.

You'll need to file a support application, Financial Statement, proof of income and three years of tax returns with your agreement.

If you are not asking the court to turn your agreement into an order, you can agree to any child support amount. The NB government may not be able to help you enforce it.

Applying for child support

Parents often apply for child support when they apply for parenting time and decision-making responsibility.

You must supply the court with a Financial Statement, three years of tax returns, and proof of income (e.g., pay stubs).

If a parent refuses to supply their financial information, the court can impute (i.e., guess) their income. For example, the court can base the payor's income on how much they would earn if they worked a minimum-wage job on a full-time basis. The court can also impute income if it seems the payor is underreporting their income on their taxes.

Paying child support

Support orders are automatically forwarded to the Office of Support Enforcement (OSE). The OSE receives payments from the payor and distributes them to the beneficiary.

The beneficiary may opt out of the program by filing a Notice Not to File Support Order. Then, they will receive payments directly from the payor. They can enroll in the OSE later if they change their mind.

Beneficiaries who don't have the court turn their support agreement into an order receive payments directly from the payor.

By the court's discretion, if the child is 19 or older, they may receive support payments instead of the money going to the beneficiary.

Modifying child support

If there's a change in circumstances that would impact the support amount, you can file a motion with the court to change the order. Follow the directions outlined in the child support variation kit to get started.

To avoid the paperwork, parents who qualify can enroll in the Child Support Recalculation Service after getting a support order. The service automatically recalculates your child support annually.

Alternatively, you can draft a revised agreement and request it be written into a consent order. If you never had your original agreement made into a court order, you can also keep this one as a private contract.

Enforcing child support

The OSE keeps a record of payments and can penalize the payor if they miss multiple payments.

The OSE can garnish the payor's wages, inform the credit bureau of their missed payments, or suspend their driver's license, among other things. The OSE cannot, however, change the support order or agreement.

If you're not enrolled in the OSE but do have a court order for child support, you can file a motion in court to enforce the order. However, it will cost money, whereas the OSE's services are free.

Even if the payor misses payments, the beneficiary cannot deny them their court-ordered or agreed-upon visitation. Similarly, the payor cannot refuse to pay support even if the beneficiary withholds the children from them.

Terminating child support

Generally, parents receive support for children until the child turns 19. Support payments can continue beyond that age if the child is disabled, completing their first postsecondary degree or cannot provide for themselves.

The order can end before the child turns 19 if they move out of the parent's household, get married or become financially independent from their parents.

To end support, the payor must contact the OSE to inform them the child is no longer eligible or ask the court to discontinue the order.

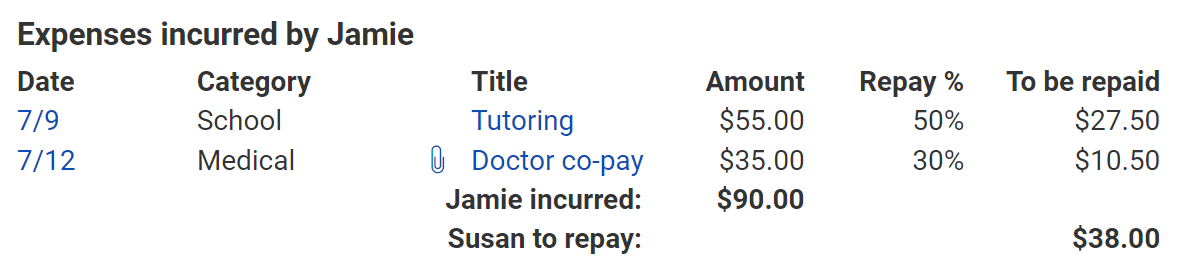

Keeping track of payments and expenses

Whether you're paying or receiving child support, the Custody X Change app can help you keep track of support payments and child-related expenses.

Try this with Custody X Change.

Try this with Custody X Change.

Log details of every payment or expense into your parenting expense tracker to ensure you're on time and paid up.

When you're owed money for expenses, share an expense report with the other parent — either digitally or on paper. This is just one way Custody X Change makes co-parenting simpler.