Alberta Child Support (Child Maintenance)

Child support, sometimes called child maintenance, ensures that a child is provided for financially by both parents.

Use the calculator above to quickly estimate the amount of support you will pay or receive if you leave the decision to the court.

Getting a support order or agreement

Parents can agree on a support amount or ask the court to decide.

If you can't agree on a support amount, apply for child support. The court uses a formula to set the payment amount. Generally, the parent who spends less time with the child pays support. However, if each parent has at least 40% of the parenting time, the parent who owes more according to the formula pays the difference between each parent's child support obligation.

If you agree on a support amount, you can create a maintenance agreement or include the amount in a parenting agreement. If the amount you agree on is far from what the court would award, you'll have to explain why. An agreement isn't valid until the court approves it.

There are resources that can help you establish child support:

- Low-income parents can contact Child Support Services. See the Child Support Services Fact Sheet for information about the services they provide.

- Parents of all income levels who live in Calgary or Edmonton can try the Child Support Resolution Program for help reaching an agreement.

Paying and receiving child support

The Maintenance Enforcement Program (MEP) collects and distributes child support payments.

Registering for the MEP is optional. If you're willing to receive support payments directly from the payor, you don't have to register. But you can register later on if the payor misses payments.

If the support recipient also gets income support, Alberta Works will subtract the monthly child support amount from their income support payment. If the child support amount is greater than income support, the person may no longer qualify for income support.

Modifying child support

You can ask the court to change your support order if need be.

There's also the Child Support Recalculation Program, which reassesses each parent's income annually to keep support in line with parental income. Either parent can register.

Enforcing child support

Contact the Maintenance Enforcement Program if a parent misses a support payment. The MEP can take money directly from the payor's wages or suspend their driver's license, among other penalties.

In some circumstances, payors can ask for a stay of enforcement. If approved, they're granted a grace period to pay back arrears (owed child support) without penalty. They will continue to accrue support payments, but the MEP won't take actions to enforce support during this time.

A payor can argue that a financial hardship makes them unable to pay arrears. If the court sides with them, it may cancel arrears, meaning the payor wouldn't owe any back payments. They'd still be responsible for support going forward.

The child support guidelines

Alberta uses two child support guidelines (sets of rules, in other words).

The Alberta Child Support Guidelines apply to parents who are not divorcing (including those who are married but separated) and nonparents caring for a child.

The Federal Child Support Guidelines apply to parents who have divorced or filed for divorce.

Both guidelines use the same formula to calculate support amounts. You can find Alberta's child support table, which the formula relies on, in the federal guidelines.

Differences between the child support guidelines

Alberta's Child Support Guidelines differ from the Federal Child Support Guidelines in four areas.

Who can apply for child support

The Alberta Child Support Guidelines allow anyone who has a child in their care to apply for child support.

The Federal Child Support Guidelines only allow parents to apply for child support.

Criteria for nonparents paying child support

The Alberta Child Support Guidelines define what it means to "stand in place of a parent" (section 48), which obligates a nonparent to pay support.

The Federal Child Support Guidelines mention that a spouse who is not the child's biological parent but acted in a parental role may have to pay support, but it's ultimately the court's decision if those involved can't agree.

Child support for adult children

The Alberta Child Support Guidelines state that support payments can continue after the child turns 18 if they are a full-time student but must end once they turn 22.

The Federal Child Support Guidelines allow support payments for adult children to continue for as long as the child is unable to care for themselves due to illness, disability or another reason. Judges generally accept school enrollment as a reason until the child has received a post-secondary degree.

Special expenses

The Alberta Child Support Guidelines allow parents to estimate how much they expect to spend on special expenses (e.g., childcare costs).

The Federal Child Support Guidelines require parents to calculate an exact amount for special expenses.

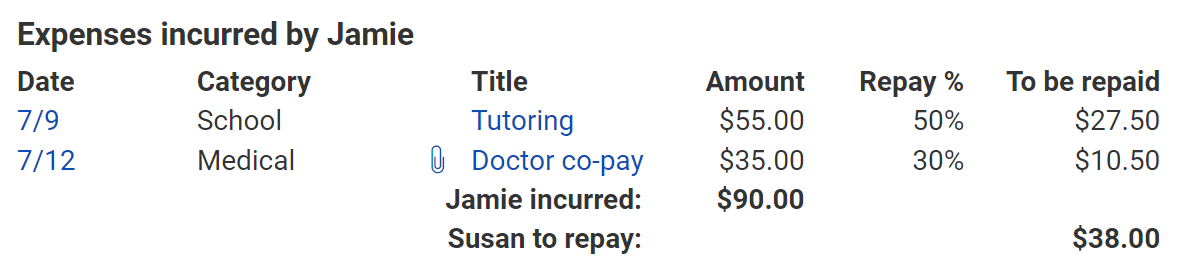

Keeping track of payments and expenses

Whether you're paying or receiving child support, the Custody X Change app can help you keep track of support payments and child-related expenses.

Try this with Custody X Change.

Try this with Custody X Change.

Log details of every payment or expense into your parenting expense tracker to ensure you're on time and paid up.

When you're owed money for expenses, share an expense report with the other parent — either digitally or on paper. This is just one way Custody X Change makes co-parenting simpler.