Child Support in Nevada

Child support evens out the financial responsibility that parents who are no longer in a relationship have to their children.

The basics of support in Nevada

In a primary physical custody arrangement, the parent with less than 40% of parenting time pays support.

In a joint physical custody arrangement (at least 40% of parenting time each), the parent with the higher income pays.

If each parent has primary custody of at least one of their shared children (which is rare), they will owe one another for the children not in their primary custody and for the children in their joint custody.

The court can order the obligor to pay retroactive child support for the past four years or from the child's birth if they're under four.

The person paying support is the obligor, and the person receiving support is the obligee.

Calculating child support

Nevada's Child Support Guidelines explain how the court determines support obligations.

First the court calculates a base support obligation. Then it adjusts that number if necessary (e.g., for joint physical custody) and adds medical support or other support that is allowed.

Use the calculator at the top of this page to quickly see your obligation (adjusted for joint physical custody if applicable). Or use Nevada's official child support calculator, which will fill out a worksheet for you. You'll need to turn in a worksheet when you apply for child support.

Base support obligations

The obligor pays a percentage of their monthly income (excluding state benefits like welfare) based on their number of children in the case. These amounts are shown in the schedule of base support obligations.

For example, for one child, the base support obligation equals:

- 16% of income up to $6,000, plus

- 8% of any income from $6,001 to $10,000, plus

- 4% of any income over $10,000

There's a separate schedule for low-income obligors.

Adjustments

With joint physical custody, the obligor pays an "offset" amount: the difference between each parent's base obligation. So if Parent A would owe $500 ordinarily and Parent B would owe $300 if they were the obligor, then Parent A will pay $200 per month after the offset.

Regardless of the physical custody arrangement, the court may adjust the base support obligation for costs like:

- Transporting the children to and from parents' homes

- Special education

- Child support paid for other children

Medical support

The court has to order medical support alongside regular child support.

If both parents have insurance, then the court will typically order them to maintain it.

If only one parent has insurance, the other is expected to reimburse them for half of the premium costs, barring a significant difference in income. Obligors get a deduction for half of the premium if they're the policy holder.

Some judges order the 30/30 rule. When one parent covers a medical cost, they have to send proof of payment to the other parent within 30 days, then the other parent has 30 days to reimburse them for half the cost or object in writing to the request for reimbursement.

Applying for child support

You can request child support when you file for custody or divorce.

If you need help finding the other parent or establishing paternity, apply for child support through Child Support Enforcement (CSE) — also called the District Attorney's Family Support Division. It's often cheaper than filing separate petitions with the court. But you will need to go to court to get a custody order.

Fill out a joint support worksheet if you are filing for custody or divorce together, even if you're not seeking joint custody. Otherwise, fill out a support worksheet for solo complaints.

Agreeing on child support

Parents can write up a support agreement together so long as the obligee is not getting public assistance and has not applied for it.

The agreement is ordered only if the court determines it would meet or exceed the child's needs.

If either parent asks the court for a support modification, the court will apply the current support guidelines.

Some parents agree to waive support altogether. Parents would need to have similar incomes or certify that the child's needs will still be met for the court to approve.

Paying and receiving child support

Child support is paid monthly until each child turns 18. It can continue until 19 if they're still in high school at that age.

Income withholding, when support is automatically deducted from the obligor's wages, is the recommended method of payment. With this method, CSE keeps a record of payments in case the obligee asks for help enforcing the order.

The obligor can instead pay support directly to the obligee via cash, check or wire transfer. Or they can pay support through the Department of Health and Human Services.

Regardless of how support is paid, the obligor should keep track of payments in case they need to go to court.

There are a few ways to receive child support.

Modifying child support

After three years or a 20% change in the obligor's income, either parent can ask the court to modify child support. Some judges require both to approve a change.

In Nevada, parents are not required to report income changes to the court. Therefore, it's often up to the obligee to prove when the obligor's income increases. A judge may order the obligor to update income if it hasn't been reported in a while. The obligor may have to pay support retroactive to the date of their income increase.

If primary physical custody of the child changes, you should file a request to change the child support obligee.

Enforcing child support

If support is paid via income withholding, the office managing your order will automatically know when there's a missed payment. Otherwise, contact CSE for enforcement help.

Possible penalties for missed support payments include revocation of the obligor's driver's license (after three months of failing to pay), fines, liens on their property and jail time.

Get in touch with CSE if you're an obligor struggling to pay support. Missed child support payments go into arrears. Arrears collect interest, so you'll owe more than what you failed to pay. You must pay it off even after the support order ends.

An obligor who fails to pay support does not lose their visitation rights, and an obligee who withholds visits does not lose their right to collect child support. Still, you should follow all court orders and agreements.

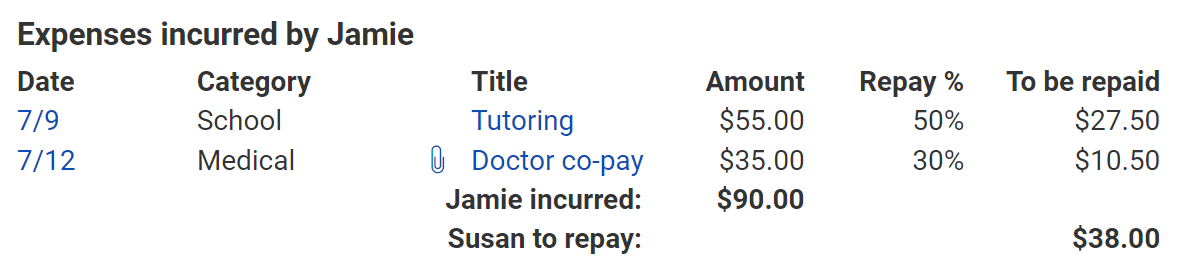

Keeping track of payments and expenses

Whether you're a custodial or noncustodial parent, the Custody X Change online app can help you keep track of support payments and child-related expenses.

Try this with Custody X Change.

Try this with Custody X Change.

Log details of every payment or expense into your parenting expense tracker to ensure that you're on time and following the court's order.

When you're owed money, share an expense report with the other parent — either digitally or on paper. This is just one way Custody X Change makes co-parenting simpler.