Appendix: How much is child support in your state?

Visit the study's main page: How much is child support in your state?

Abstract

In April and May of 2019, researchers from Custody X Change investigated how much child support one family would be awarded in each of the 50 U.S. states. The researchers entered the hypothetical family's information into each state's guideline child support formula, verifying each other's calculations along the way. The results show that the size of a child support payment depends heavily on which state the family calls home.

Introduction

The federal government requires every state to develop child support guidelines, which help courts determine the appropriate award in any case. The government introduced this requirement in the 1980s after studies showed major inconsistencies in how judges were awarding support, both within and among states.4

Each state must convene a panel to review its guidelines every four years.5

Most states have overhauled their child support formulas significantly as American families have changed. Guidelines once assumed mothers worked less than fathers, if at all. In addition, they were often based on the presumption that parents had at one point been married to each other.3

Today, much of the debate around child support concentrates on finding an amount that provides for the child without leaving the paying parent destitute. Some states have found that lowering payments or forgiving outstanding payments can increase overall child support collection numbers, as the payers are better able to afford their obligation.2

This research aims to support dialogue about how to determine the right amount of child support for each family, and about how to find an appropriate balance between consistency and flexibility in child support rulings.

Methods

The research team followed the steps outlined below to carry out the research.

1. Definition of variables

First, the research team defined its hypothetical family.

- Children: The family has two children, ages 7 and 10.

- Parenting time: The mother has 65% of custody time, or 237 overnights a year (the most common timeshare awarded to a U.S. mother, according to previous research from Custody X Change). The father has 35% of time, or 128 overnights a year.

- Incomes: The mother earns a $45,000 salary each year ($35,100 in net income after taxes and deductions). The father earns a $55,000 salary ($42,900 in net income after taxes and deductions). Neither receives public assistance or any other income. These figures are based on data about typical parental incomes from Pew Research Center.

- Deductions: Neither parent makes payments for alimony, childcare, health insurance, transportation, union dues, etc.

- Other details: Neither parent is remarried, nor do they have other children. No special needs or circumstances exist.

2. Calculations

Next, the team entered the above details into each state's guideline child support formula or calculator to determine how much the father would owe, barring any deviations granted by a judge.

As first preference, the team used the most reliable calculator available for each state. (Reliability was based on the credibility of the organization or person providing the calculator, and a cross-check of results against other sources.) When a calculator could not be found, the team manually calculated the guideline award using the most reliable worksheet or formula available.

The calculators, worksheets or formulas used were accessed at the links below in April and May of 2019.

| State | Calculator, worksheet or formula |

| Alabama | https://www.danibone.com/alabama-child-support-calculator |

| Alaska | https://public.courts.alaska.gov/web/forms/docs/dr-305.pdf https://public.courts.alaska.gov/web/forms/docs/dr-306.pdf |

| Arizona | https://www.arizonalawgroup.com/child-support-calculator/ |

| Arkansas | http://www.divorcehq.com/calculators/arkansas-child-support-calculator.shtml |

| California | https://www.cse.ca.gov/ChildSupport/cse/guidelineCalculator |

| Colorado | https://www.courts.state.co.us/Forms/Forms_List.cfm?Form_Type_ID=94 |

| Connecticut | https://www.jud.ct.gov/Publications/ChildSupport/CSguidelines.pdf |

| Delaware | https://courts.delaware.gov/family/supportcalculator/Summary.aspx |

| Florida | https://www.18884mydivorce.com/calculators/florida-child-support-calculator/ |

| Georgia | https://csconlinecalc.georgiacourts.gov/frontend/web/ |

| Hawaii | http://www.cuskadenlaw.com/calc.php |

| Idaho | http://www.idahochildsupportcalculation.com/ |

| Illinois | https://s3.amazonaws.com/law-media/uploads/820/50489/original/IL Child Support Schedules - Sheet1.pdf https://www.illinoislegalaid.org/legal-information/calculating-child-support-one-parent-has-less-146-overnights |

| Indiana | https://mycourts.in.gov/csc/Practitioners/default.aspx |

| Iowa | https://secureapp.dhs.state.ia.us/estimator/ |

| Kansas | https://efamilytools.com/app/signup |

| Kentucky | https://csws.chfs.ky.gov/csws/General/EstimateDisclaimer.aspx |

| Louisiana | https://office.lopresto-law.com/child-support-calculator/ |

| Maine | https://lawhelpinteractive.org/Interview/GenerateInterview/1975/engine |

| Maryland | http://www.dhr.state.md.us/CSOCGuide/App/disclaimer.do |

| Massachusetts | http://www.divorcehq.com/calculators/massachusetts-child-support-calculator.shtml |

| Michigan | https://micase.state.mi.us/calculatorapp/public/welcome/load.html |

| Minnesota | https://childsupportcalculator.dhs.state.mn.us |

| Mississippi | http://www.robertson.ms/services/view/child-support?categoryID=39573 |

| Missouri | http://www.freeform14.com/ |

| Montana | https://app.mtchildsupport.com/users/sign_in |

| Nebraska | https://ne.childsupportcalculator.com/ |

| Nevada | http://selfhelp.nvcourts.gov/images/misc/childsupport-worksheeta-pdf-fillable.pdf |

| New Hampshire | https://business.nh.gov/dhhs_Calculator/ |

| New Jersey | https://www.njcourts.gov/self-help/forms?catalog=10727 https://www.njcourts.gov/attorneys/assets/rules/app9f.pdf |

| New Mexico | https://www.divorcenm.com/legal-resources/divorce-custody-calculators/new-mexico-child-support-calculator/ |

| New York | https://www.nycourts.gov/LegacyPDFs/divorce/childsupport/UD-8-3-ChildSupportWorksheet.pdf |

| North Carolina | https://www.charlesullman.com/legal-services/child-support-lawyer/calculator/ |

| North Dakota | https://childsupport.dhs.nd.gov/sites/default/files/Schedule D - Adjustment for Parenting Time.pdf |

| Ohio | https://ohiochildsupportcalculator.ohio.gov/pages/calculator.html |

| Oklahoma | http://www.okdhs.org/onlineservices/cscalc/Pages/cscalc.aspx |

| Oregon | https://justice.oregon.gov/guidelines/summary.aspx |

| Pennsylvania | https://www.humanservices.state.pa.us/CSWS/csws_controller.aspx |

| Rhode Island | http://www.cse.ri.gov/guidelines/index.php |

| South Carolina | https://dss.sc.gov/child-support/calculator/ |

| South Dakota | http://apps.sd.gov/SS17PC02CAL/Calculator.aspx |

| Tennessee | https://www.tn.gov/humanservices/for-families/child-support-services/child-support-guidelines-downloads.html |

| Texas | https://csapps.oag.texas.gov/monthly-child-support-calculator |

| Utah | https://orscsc.dhs.utah.gov/orscscapp-hs/orscscweb/actions/Csc0002 |

| Vermont | https://childsupportcalculator.ahs.state.vt.us/#/expert |

| Virginia | https://www.vasupportcalc.com/unified-calculator/ |

| Washington | https://fortress.wa.gov/dshs/dcs/SSGen/Home/QuickEstimator |

| West Virginia | http://www.wvlegislature.gov/wvcode/ChapterEntire.cfm?chap=48&art=13§ion=502 http://www.wvlegislature.gov/wvcode/code.cfm?chap=48&art=13 |

| Wisconsin | https://dcf.wisconsin.gov/index.php/cs/order/tools (Shared-placement calculator) |

| Wyoming | https://childsupport.wyoming.gov/calculator/ |

Additional process notes:

To convert a weekly number into a monthly figure, the weekly number was first multiplied by 52, then divided by 12. The reverse process was used to convert a monthly number into weekly: multiply by 12, then divide by 52.

Wherever possible, the team adjusted inputs (such as local taxes, FICA taxes, etc.) to arrive at a net income of $35,100 for the mother and $42,900 for the father. In some cases, the support calculators automatically computed net income, and reaching the exact target figures wasn't possible.

When a state's child support schedule did not specify whether total combined income should be rounded up or down to find the coordinating basic support obligation, the researchers rounded down. For example, if a state offered basic support obligations for monthly combined incomes of $8,300 and $8,350, this study used the number for $8,300 (because the true combined income for the parents studied was $8333.33).

3. Comparison with national indexes

Finally, the team compared the guideline awards with various national indexes, three of which are included below. See the "discussion" section for details of how they compare to the child support awards in each state.

| State | Cost of living score* |

| Alabama | 86.6 |

| Alaska | 105.4 |

| Arizona | 95.9 |

| Arkansas | 86.9 |

| California | 114.4 |

| Colorado | 103 |

| Connecticut | 108.7 |

| Delaware | 100.2 |

| Florida | 99.7 |

| Georgia | 92.1 |

| Hawaii | 118.4 |

| Idaho | 93 |

| Illinois | 98.9 |

| Indiana | 90.3 |

| Iowa | 90.2 |

| Kansas | 90.5 |

| Kentucky | 87.8 |

| Louisiana | 90.4 |

| Maine | 98.4 |

| Maryland | 109.5 |

| Massachusetts | 107.8 |

| Michigan | 93.3 |

| Minnesota | 97.5 |

| Mississippi | 86.4 |

| Missouri | 89.5 |

| Montana | 94.1 |

| Nebraska | 90.5 |

| Nevada | 97.4 |

| New Hampshire | 105.9 |

| New Jersey | 113.2 |

| New Mexico | 93.6 |

| New York | 115.6 |

| North Carolina | 90.9 |

| North Dakota | 91.5 |

| Ohio | 89.3 |

| Oklahoma | 89 |

| Oregon | 99.8 |

| Pennsylvania | 98.4 |

| Rhode Island | 99.6 |

| South Carolina | 90.3 |

| South Dakota | 88.3 |

| Tennessee | 90.2 |

| Texas | 96.9 |

| Utah | 97.3 |

| Vermont | 101.6 |

| Virginia | 102.3 |

| Washington | 105.5 |

| West Virginia | 87.6 |

| Wisconsin | 92.8 |

| Wyoming | 96.7 |

*Source: U.S. Bureau of Economic Analysis, 2016 index of regional price parity for all items

A state's regional price parity (RPP) score reflects how prices there compare to prices nationally. A score of 100 means the state's prices are exactly in line with national price levels. States with lower scores have lower prices, whereas states with higher scores have higher prices.

| State | Political leaning** |

| Alabama | Republican |

| Alaska | Republican |

| Arizona | Competitive |

| Arkansas | Republican |

| California | Democrat |

| Colorado | Democrat |

| Connecticut | Democrat |

| Delaware | Democrat |

| Florida | Competitive |

| Georgia | Competitive |

| Hawaii | Democrat |

| Idaho | Republican |

| Illinois | Democrat |

| Indiana | Competitive |

| Iowa | Competitive |

| Kansas | Republican |

| Kentucky | Competitive |

| Louisiana | Competitive |

| Maine | Democrat |

| Maryland | Democrat |

| Massachusetts | Democrat |

| Michigan | Democrat |

| Minnesota | Democrat |

| Mississippi | Republican |

| Missouri | Republican |

| Montana | Republican |

| Nebraska | Republican |

| Nevada | Competitive |

| New Hampshire | Competitive |

| New Jersey | Democrat |

| New Mexico | Democrat |

| New York | Democrat |

| North Carolina | Competitive |

| North Dakota | Republican |

| Ohio | Competitive |

| Oklahoma | Republican |

| Oregon | Democrat |

| Pennsylvania | Competitive |

| Rhode Island | Democrat |

| South Carolina | Republican |

| South Dakota | Republican |

| Tennessee | Republican |

| Texas | Competitive |

| Utah | Republican |

| Vermont | Democrat |

| Virginia | Democrat |

| Washington | Democrat |

| West Virginia | Competitive |

| Wisconsin | Competitive |

| Wyoming | Republican |

**Source: Annual state averages of party affiliation from Gallup Daily tracking, 2017

| State | Guideline support model*** |

| Alabama | Income shares |

| Alaska | Hybrid |

| Arizona | Income shares |

| Arkansas | Percentage of obligor's income |

| California | Income shares |

| Colorado | Income shares |

| Connecticut | Income shares |

| Delaware | Melson formula |

| Florida | Income shares |

| Georgia | Income shares |

| Hawaii | Melson formula |

| Idaho | Income shares |

| Illinois | Income shares |

| Indiana | Income shares |

| Iowa | Income shares |

| Kansas | Income shares |

| Kentucky | Income shares |

| Louisiana | Income shares |

| Maine | Income shares |

| Maryland | Income shares |

| Massachusetts | Income shares |

| Michigan | Income shares |

| Minnesota | Income shares |

| Mississippi | Percentage of obligor's income |

| Missouri | Income shares |

| Montana | Melson formula |

| Nebraska | Income shares |

| Nevada | Hybrid |

| New Hampshire | Income shares |

| New Jersey | Income shares |

| New Mexico | Income shares |

| New York | Income shares |

| North Carolina | Income shares |

| North Dakota | Percentage of obligor's income |

| Ohio | Income shares |

| Oklahoma | Income shares |

| Oregon | Income shares |

| Pennsylvania | Income shares |

| Rhode Island | Income shares |

| South Carolina | Income shares |

| South Dakota | Income shares |

| Tennessee | Income shares |

| Texas | Percentage of obligor's income |

| Utah | Income shares |

| Vermont | Income shares |

| Virginia | Income shares |

| Washington | Income shares |

| West Virginia | Income shares |

| Wisconsin | Hybrid |

| Wyoming | Income shares |

***Source: National Conference of State Legislatures, 2019, with updates by Custody X Change

Results

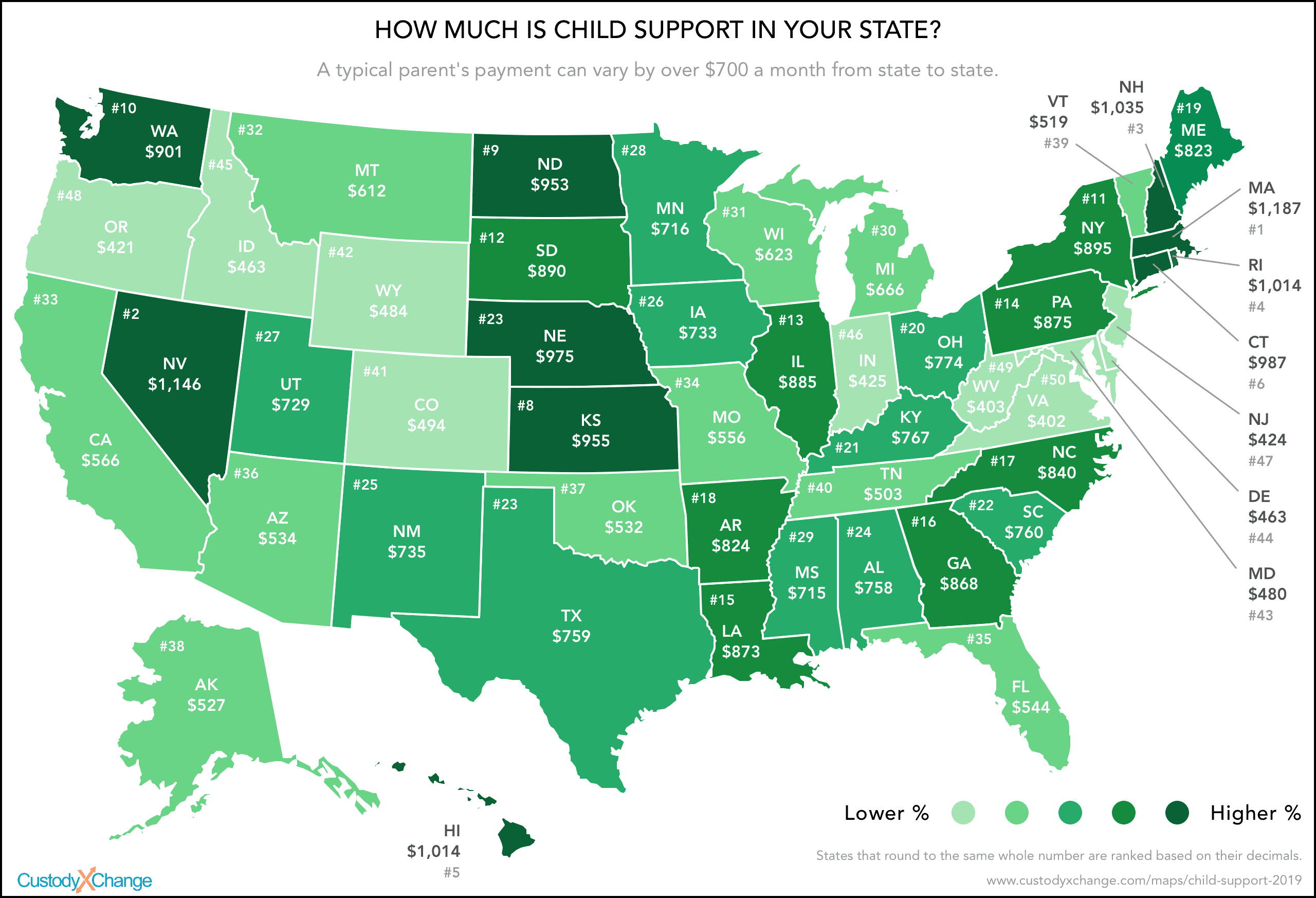

The results show that the size of a child support payment depends heavily on which state the family calls home.

A parent can pay three times as much as one who lives in a state just six hours away, despite their circumstances being otherwise equal. When a Virginia parent would pay $400 a month in child support, a Massachusetts parent in the same situation would pay nearly $1,200, according to state guidelines.

The father's payment could range from $402 a month to $1,187 a month. Nationally, he would pay an average of $721 monthly, and a median monthly payment of $734.

Download: PNG | JPG; Use image with attribution

| State | Guideline support result | Rank |

| Alabama | $757.90 | 24 |

| Alaska | $526.50 | 38 |

| Arizona | $533.92 | 36 |

| Arkansas | $824.00 | 18 |

| California | $566.00 | 33 |

| Colorado | $494.00 | 41 |

| Connecticut | $986.70 | 6 |

| Delaware | $463.00 | 44 |

| Florida | $544.00 | 35 |

| Georgia | $868.00 | 16 |

| Hawaii | $1,014.05 | 5 |

| Idaho | $462.60 | 45 |

| Illinois | $885.00 | 13 |

| Indiana | $424.67 | 46 |

| Iowa | $733.00 | 26 |

| Kansas | $955.00 | 8 |

| Kentucky | $767.25 | 21 |

| Louisiana | $872.85 | 15 |

| Maine | $823.33 | 19 |

| Maryland | $480.11 | 43 |

| Massachusetts | $1,187.33 | 1 |

| Michigan | $665.51 | 30 |

| Minnesota | $716.00 | 28 |

| Mississippi | $715.00 | 29 |

| Missouri | $556.00 | 34 |

| Montana | $612.00 | 32 |

| Nebraska | $975.00 | 7 |

| Nevada | $1,146.00 | 2 |

| New Hampshire | $1,035.00 | 3 |

| New Jersey | $423.58 | 47 |

| New Mexico | $735.15 | 25 |

| New York | $895.00 | 11 |

| North Carolina | $840.40 | 17 |

| North Dakota | $953.00 | 9 |

| Ohio | $774.21 (includes 2% processing fee) | 20 |

| Oklahoma | $532.17 | 37 |

| Oregon | $421.00 | 48 |

| Pennsylvania | $875.00 | 14 |

| Rhode Island | $1,014.20 | 4 |

| South Carolina | $759.53 | 22 |

| South Dakota | $890.00 | 12 |

| Tennessee | $503.00 | 40 |

| Texas | $758.63 | 23 |

| Utah | $729.00 | 27 |

| Vermont | $518.55 | 39 |

| Virginia | $402.00 | 50 |

| Washington | $901.00 | 10 |

| West Virginia | $402.60 | 49 |

| Wisconsin | $622.86 | 31 |

| Wyoming | $484.39 | 42 |

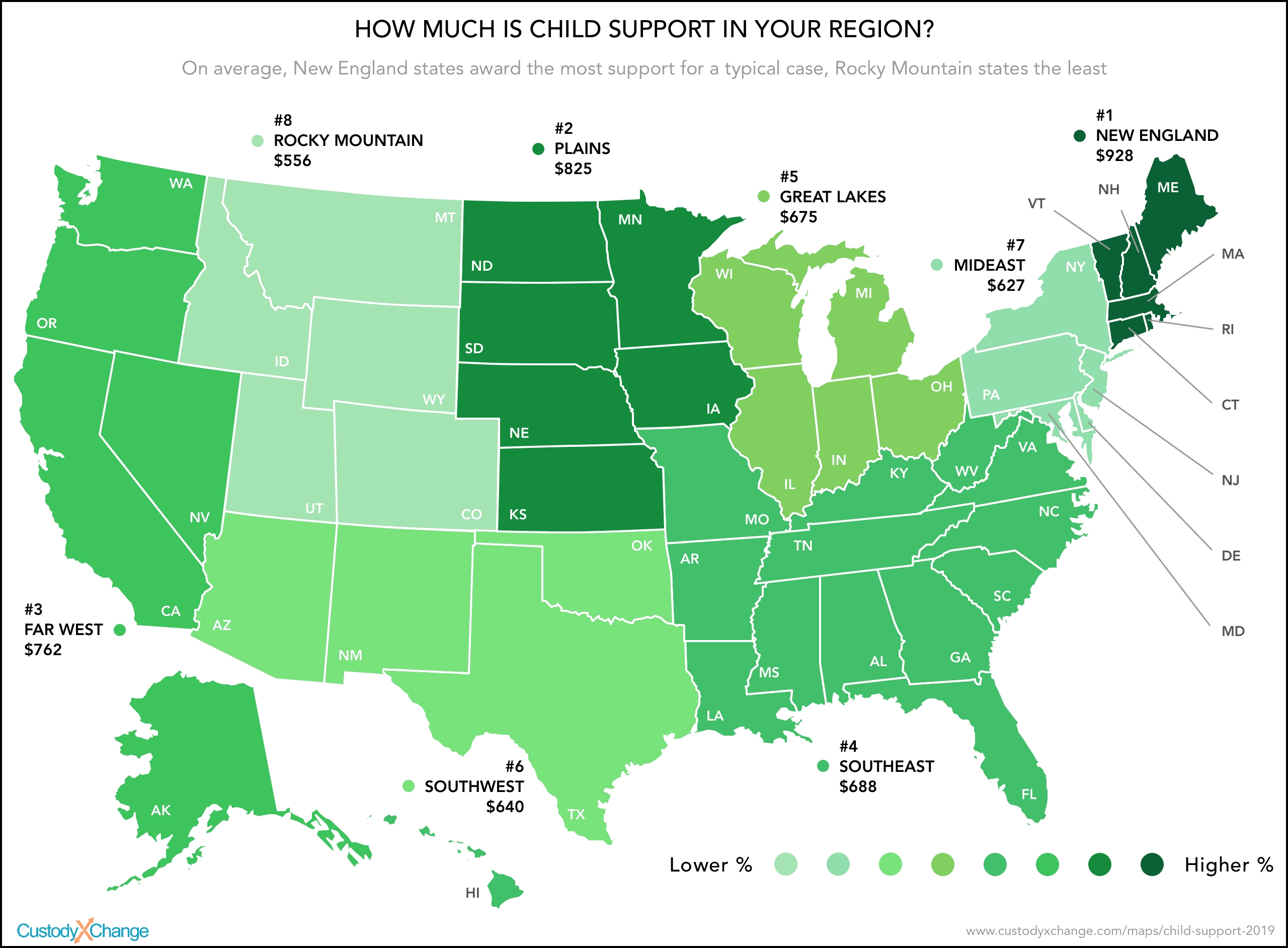

| Regional average of support results* | Rank | |

| New England | $928 | 1 |

| Connecticut | ||

| Maine | ||

| Massachusetts | ||

| New Hampshire | ||

| Rhode Island | ||

| Vermont | ||

| Plains | $825 | 2 |

| Iowa | ||

| Kansas | ||

| Minnesota | ||

| Missouri | ||

| Nebraska | ||

| North Dakota | ||

| South Dakota | ||

| Far West | $762 | 3 |

| Alaska | ||

| California | ||

| Hawaii | ||

| Nevada | ||

| Oregon | ||

| Washington | ||

| Southeast | $688 | 4 |

| Alabama | ||

| Arkansas | ||

| Florida | ||

| Georgia | ||

| Kentucky | ||

| Louisiana | ||

| Mississippi | ||

| North Carolina | ||

| South Carolina | ||

| Tennessee | ||

| Virginia | ||

| West Virginia | ||

| Great Lakes | $675 | 5 |

| Illinois | ||

| Indiana | ||

| Michigan | ||

| Ohio | ||

| Wisconsin | ||

| Southwest | $640 | 6 |

| Arizona | ||

| New Mexico | ||

| Oklahoma | ||

| Texas | ||

| Mideast | $627 | 7 |

| Delaware | ||

| Maryland | ||

| New Jersey | ||

| New York | ||

| Pennsylvania | ||

| Rocky Mountain | $556 | 8 |

| Colorado | ||

| Idaho | ||

| Montana | ||

| Utah | ||

| Wyoming |

*Regional groupings come from the U.S. Bureau of Economic Statistics

Discussion

The research demonstrates inconsistency in guideline child support amounts across the country, without many clear patterns.

The variation may be due to the different processes states use to set their guidelines. A few states have worked with researchers to measure the cost of raising a child there. Others have used existing research (which may employ data from another state or at the national level), or they haven't referred specifically to any evidence.6

Even among states that point to research, the studies they consult vary in methodology and age. The most common source is the Consumer Expenditure Survey from the U.S. Bureau of Labor Statistics. Since it doesn't offer data at the state level, some states have adjusted its data to try to match their cost of living. Other state-specific modifications to data and models further add to the lack of uniformity in awards across the U.S.6

Other factors are considered below.

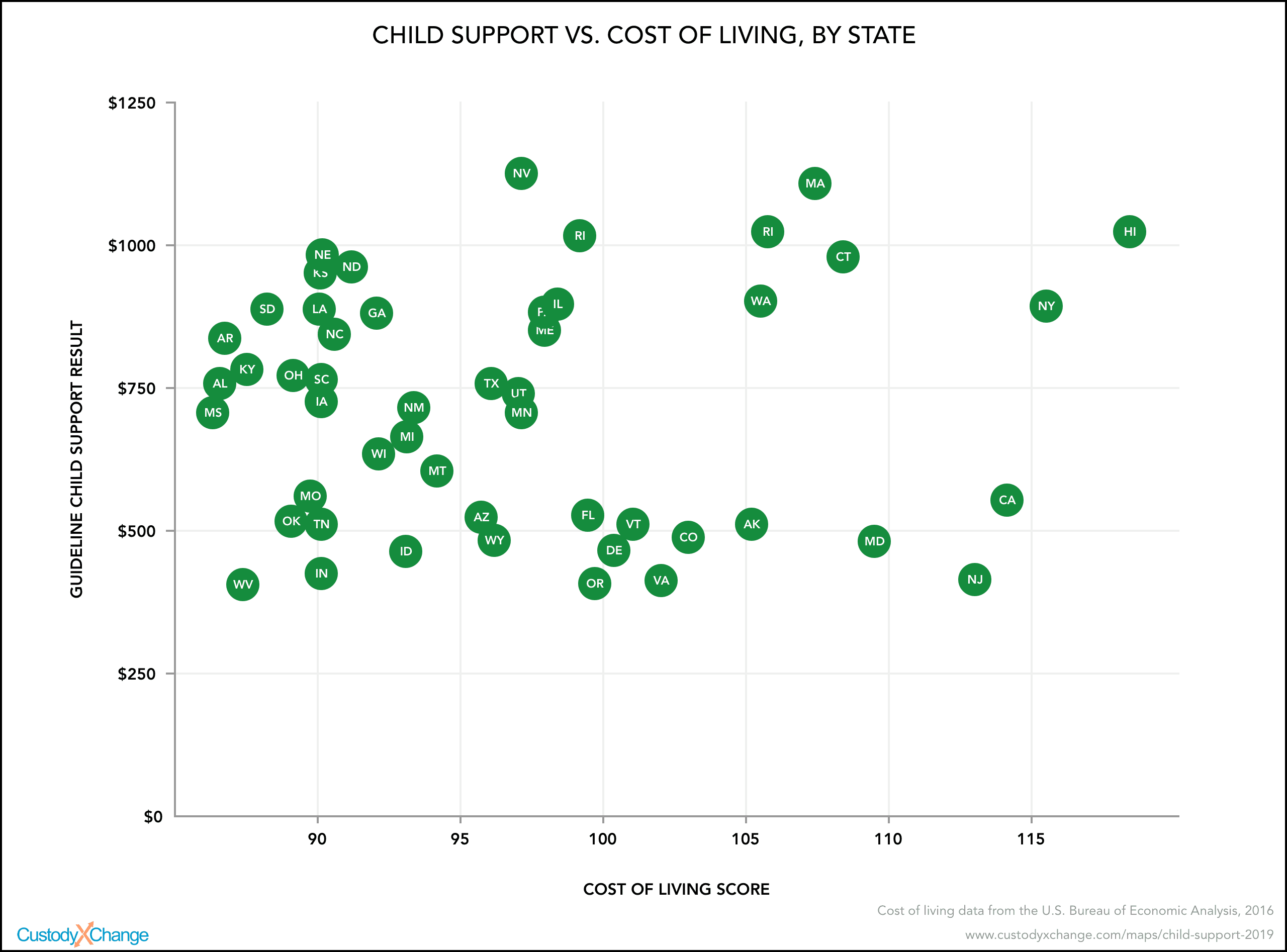

Cost of living, political leaning don't explain the variation

Perhaps surprisingly, the results revealed that child support rates don't significantly correlate with a state's cost of living.

Of the five most expensive states to live in — Hawaii, New York, California, New Jersey and Maryland — one (Hawaii) ranks among the 10 highest child support calculations in the study, but two (New Jersey and Maryland) rank among the lowest 10 calculations.

Meanwhile, Massachusetts, which awards the highest support payment for this family, has the seventh highest cost of living in the nation. Virginia has a comparable cost of living (12th highest in the U.S.), yet awards the least support.

Download: PNG | JPG; Use image with attribution

Political leaning also fails to provide an explanation for the variation in support. Average awards from Republican and Democratic states for this mother are just $13 apart ($702 and $715 a month, respectively).

Four states only consider one parent's income, award $100 more monthly

Only four states don't consider the mother's income when calculating this family's child support:

- Arkansas

- Mississippi

- North Dakota

- Texas

In these states, the family's child support payment is $100 higher than in the rest of the country, on average. Whereas these states award the family an average of $813 monthly, the other 46 states award $713 on average.

Historically, many states calculated child support by taking a percentage of money earned by the parent who spent less time with the child. As the number of working mothers has ballooned in recent decades, most states have moved to formulas that factor in both parents' incomes. Arkansas will become the latest state to make this move, by March.

For the family in the study, formulas that look only at the father's earnings produce high totals. This is because they don't consider that the hypothetical parents have similar income levels.

If the mother's income were to drop, the presumed awards in the same four states could be among the lowest in the country; they would remain static while the awards in other states would increase.

Rocky Mountain region awards the lowest payment, New England the highest

The Rocky Mountain region awards this mother the least child support: $556 a month, on average.

New England awards the most; at $928 a month, its average is 67% higher than that of the Rocky Mountain region. Vermont is a New England outlier, with the 12th lowest payment in the nation ($519), but it's not enough to knock New England out of the top spot.

Download: PNG | JPG; Use image with attribution

Considerations

These totals reflect how much a state presumes the noncustodial parent should pay (the "guideline" amount), but judges have the discretion to award different amounts based on evidence.7 In some cases, parents can decide together how much support will be exchanged.4

Because states are required to review their guidelines every four years, changes to child support legislation are frequent.5 For example, Arkansas' guidelines will change by March 2020, and Maryland's laws are expected to be amended in 2019.1, 7

This research is dependent on the accuracy of state calculators and worksheets.

Some states' calculators automatically deduct for taxes, whereas others ask the preparer to deduct taxes manually. Every effort was made to maintain a consistent net income for each parent across states.

Areas for further research

- How much child support would a family with different demographics (income levels, parenting timeshares, number of children, etc.) than the family in the current study be awarded in each of the 50 U.S. states?

- How do the frequent changes to child support guidelines affect presumed awards and the percentage of payments collected in each state?

- How often do courts deviate from state child support guidelines? When, and why?

Works cited

- "Breaking News! (New Child Support Laws Coming to Arkansas)." The Hudson Law Firm, P.L.L.C., 10 May 2019, hudsonlawfirmnwa.com/new-child-support-laws-coming-to-arkansas/.

- Brown, Christopher A. "The Surprising Facts about Payments of Child Support." The Father Factor, National Fatherhood Initiative, 5 June 2014, www.fatherhood.org/fatherhood/the-surprising-facts-about-payments-of-child-support.

- "Child Support Guidelines." Findlaw, family.findlaw.com/child-support/child-support-guidelines.html.

- "Child Support Guidelines." North Carolina Divorce Law, Rosen Law Firm, 20 Feb. 2019, www.rosen.com/childsupport/child-support-guidelines/.

- United States, Congress, Title 45 - Public Welfare. 2008.

- Venohr, Jane C. "Differences in State Child Support Guidelines Amounts: Guidelines Models, Economic Basis, and Other Issues." Journal of the American Academy of Matrimonial Lawyers, vol. 29, no. 2, 2017, pp. 377–407.

- Wenger, Yvonne. "Child Support Would Be Calculated Differently under Bills Being Considered by Maryland General Assembly." The Baltimore Sun, 12 Mar. 2019, www.baltimoresun.com/news/maryland/politics/bs-md-child-support-bills-20190306-story.html.