Washington Child Support Calculations

Washington expects each parent to contribute to their child's care financially.

Typically, support gets deducted automatically from the payer's paycheck. Sometimes you can pay child support online, by mail, by phone or in person (at a store or government office or directly to the other parent, with approval from the court).

Child support formula and worksheet

Since the primary residential parent (whoever has more time in the residential schedule) presumably spends more on the child to start, the nonprimary residential parent pays them child support.

In most cases, the judge sets child support using the state's formula as a guide. However, when parents agree on a support amount in a settlement, the judge approves it if it meets the child's best interests.

Courts across the state use the same formula to determine a parent's child support obligation. It's simplified below to help you estimate your payment. Use the calculator above to instantly estimate your support payment.

To apply for child support, you must complete the full formula on Washington's child support worksheet and submit it to the court.

Step 1: Determine the combined monthly net income

Begin with each parent's monthly gross income — any money they get in a regular month from work, investments, spousal maintenance (alimony), etc.

Subtract from each parent's total what they pay monthly in income taxes, self-employment taxes, voluntary retirement contributions (up to $5,000 a year), spousal maintenance or other approved deductions listed on the worksheet.

Now you have each parent's monthly net income. Add the figures together to get the combined monthly net income.

Example: Alexis and Blake have one child. Alexis is the primary residential parent and makes $3,000 a month after deductions, while Blake makes $3,500. Their combined monthly net income is $6,500.

Step 2: Find the basic support obligation

Locate the combined monthly income in the far left column of the Washington child support schedule (on page 14). If necessary, round up or down to the nearest figure.

Find where that row intersects the column matching the number of children in your case.

The number you land on represents the basic support obligation you share with the other parent.

Example: With a combined monthly net income of $6,500 and only one child, Alexis and Blake share a $1,081 basic support obligation.

Step 3: Calculate each parent's share of income

Divide your individual monthly net income by the combined monthly net income to find your proportional share. Repeat for the other parent.

Example: Alexis divides her monthly net income of $3,000 by $6,500. The result (.462) shows she has a 46.2 percent share. Blake's share is 53.8 percent.

Step 4: Determine the paying parent's support obligation

Finally, multiply the basic support obligation by the nonprimary residential parent's share of income.

The result shows how much they must pay the other parent monthly.

Example: Blake, the nonprimary parent, multiplies the basic support obligation ($1,081) by his percentage share (.538), resulting in $582. Blake pays this amount to Alexis each month.

Low-income exceptions

If the nonprimary parent's monthly net income falls below 125 percent of the federal poverty guideline, the court may assign a lower payment, but not less than $50 per child. A similar drop occurs when parents have a combined monthly net income lower than $1,000.

When one parent pays support through the state, the state passes along the full amount that's owed for the current month. However, if they're behind on child support and if the parent who receives support has ever received public assistance like WorkFirst, the state may collect the back support as reimbursement for the public assistance.

Additional expenses

Child support is designed to cover a child's usual needs, like food, clothing and shelter. It does not cover other large costs ― medical bills, school tuition, etc. The parenting plan should specify how parents will pay these extra expenses.

If parents have similar incomes, they usually split the costs evenly. Otherwise, each typically contributes an amount proportional to their income.

Modifications

A parent can request a child support modification at any time if the family has had a significant shift in circumstances, such as a job loss or major salary change. Use a Petition to Modify Child Support Order, which can change the support amount or other requirements, like which parent pays for child care.

If your child support order is at least a year old, you can file the petition without proving a significant change in circumstances. Instead, you have to show that the order causes hardship to you or the child.

If your order is at least two years old, you have an additional option ― You can file a Motion to Adjust Child Support Order, as long as a parent's income or the child support formula has changed. This asks the court to change the support amount only.

Enforcement

Any parent owed child support can inform the Division of Child Support (DCS), which may trigger an investigation.

If child support hasn't been paid for six months or if more than six months support is owed, the DCS might garnish the other parent's wages, suspend their driver's license or report the information to credit agencies.

Keeping track of payments and expenses

Remember that a child support order is legally binding and must be taken seriously.

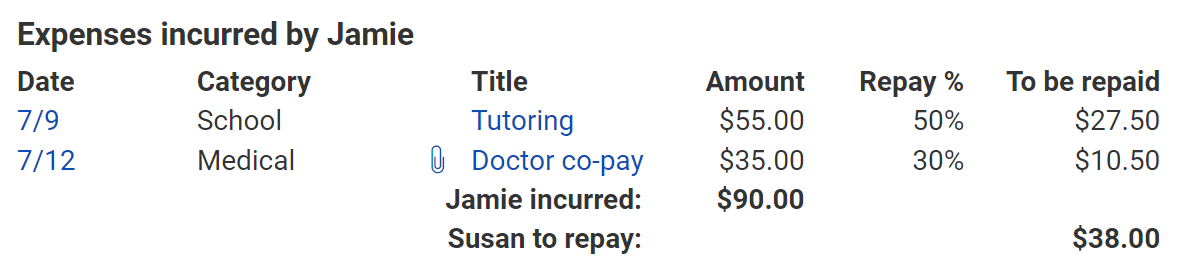

Whether you're the primary or nonprimary residential parent, the Custody X Change app can help you keep track of payments. Log details of every one into your parenting expense tracker to ensure you're sticking to the court order.

Try this with Custody X Change.

Try this with Custody X Change.

You can also track other child-related expenses and print an invoice if the other parent needs to reimburse you.

Custody X Change keeps you on top of all aspects of child custody, including payments and expenses.