Calculating Child Support in Florida

Child support ensures both parents contribute financially to their children's care. Usually, the parent with less parenting time pays their share to the majority-time parent. In cases of 50/50 time-sharing, the parent who makes more generally pays the other parent. Use the child support calculator above to estimate your payment amount using Florida's formula.

Despite common misconceptions, a child support order is required in all parental responsibility cases, unless support is handled in another proceeding (e.g., a Department of Revenue case).

Factors in the Florida child support formula

It's important to be aware of the formula, because:

- Even if you settle with the other parent on an amount that seems appropriate to you, the state can't enforce your child support agreement until a judge approves it. Judges are far more likely to give approval if you follow the formula.

- If you go to trial, the judge will decide child support using Florida's formula. They'll consider special circumstances and requests for deviation.

Florida's support formula takes the following factors into account.

Parents' monthly net incomes

Adding together each parent's monthly net income determines their combined available income. The state uses this figure to set parents' basic monthly obligation, or how much they're expected to spend on their children each month.

Each parent is responsible for part of the basic monthly obligation, proportional to their income. For example, if you earn 30% of the combined available income, you are responsible for 30% of the basic monthly obligation.

Number of eligible children

The more children involved in a case, the more support required. Qualifying children must be under 18 or still in high school. If a child has special needs, the court may order support beyond those limits.

Time-sharing

The formula includes time-sharing only when both parents have the children for 73 or more overnight visits a year (at least 20% of parenting time). As their parenting time increases, their monthly obligation decreases because they are presumably spending more on the children already.

You can calculate your parenting time instantly with Custody X Change or count manually, taking into account holidays and one-time adjustments to the schedule.

If a parent doesn't fulfill their ordered parenting time, the court may recalculate payments.

Medical, dental and child care costs

Child support orders factor in how much parents pay toward child care, medical/dental insurance and other health expenses for the children, unless their parenting plan handles these costs separately.

Steps to calculating

Follow the steps below to estimate how much child support a judge will order in your case. You can also use the Florida child support calculator at the top of this page.

Florida's Child Support Guidelines Worksheet can guide you through the math. You must serve a completed copy of the worksheet on the other parent.

Step 1: Calculate each parent's monthly net income

Within 45 days of the case's filing date, each parent must submit a Family Law Financial Affidavit. (Find it along with other court forms. Use the short version if your annual gross income is under $50,000.)

On this form, you will calculate your monthly net income by subtracting taxes, your health care premium (but not the children's) and other court-approved deductions from your monthly gross income.

Example: Jamie and Alex have two children. Jamie's monthly gross income is $5,100; after deductions her net income is $4,000. Alex's monthly gross income is $2,750; his net income after deductions is $2,400.

Step 2: Determine monthly combined available income

Add parents' monthly net incomes together to determine their monthly combined available income.

Example: Jamie and Alex add their monthly net incomes together to arrive at a monthly combined available income of $6,400.

Step 3: Calculate percentages of financial responsibility

Divide either parent's net income by the combined available income. Multiply the result by 100 to get their percentage of financial responsibility.

The remaining percentage is the other parent's responsibility.

Example: Jamie divides her net income of $4,000 by $6,400 (the combined net income from Step 2). She multiplies the result (.625) by 100 to get 62.5, her percentage of financial responsibility. Alex is responsible for the other 37.5%.

Step 4: Determine basic monthly obligation

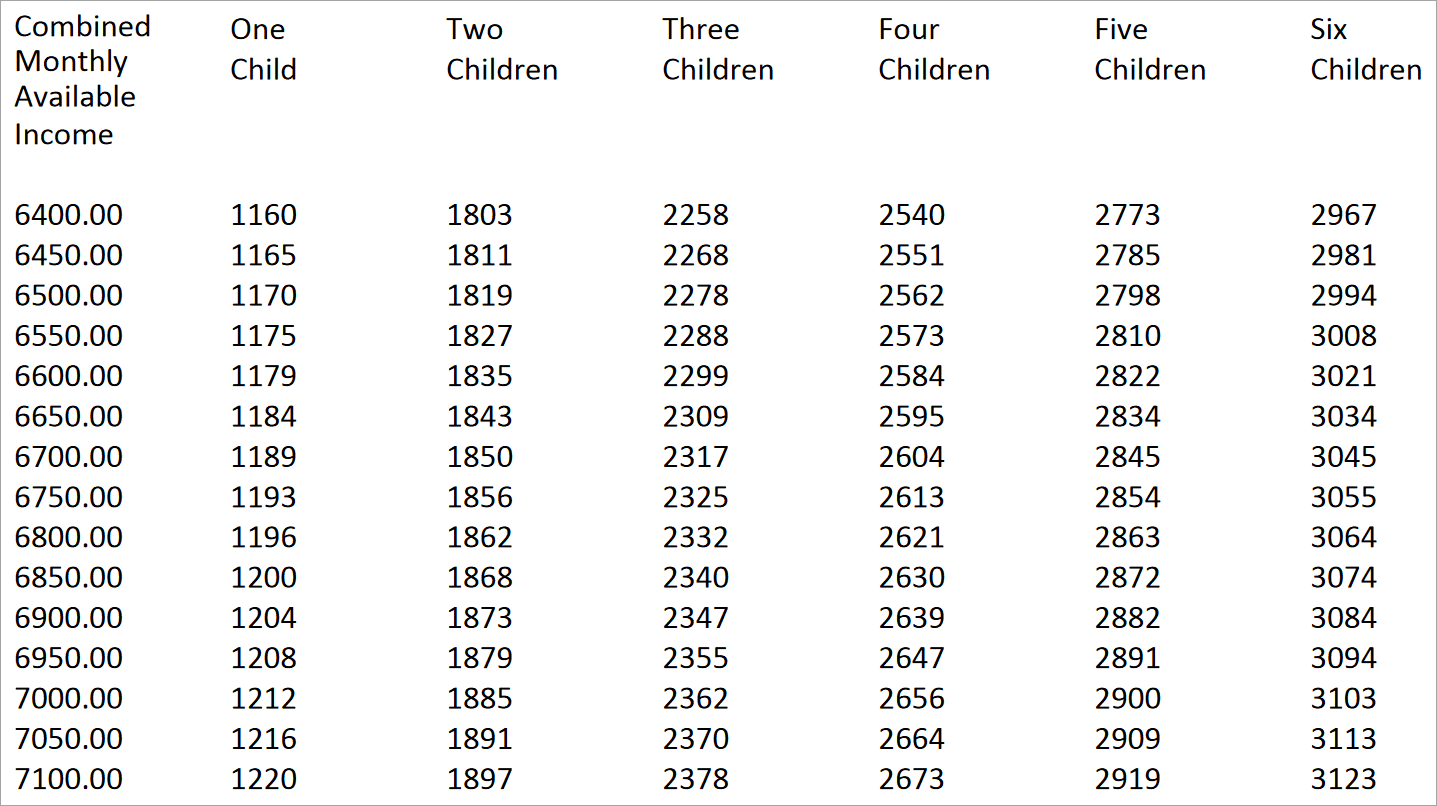

Refer to the Child Support Guidelines Worksheet. In the table's first column, find the combined available income you calculated in Step 2. (Round up for in-between figures.) Then, look across that row to the column labeled with the number of children in your case. This is the basic monthly obligation parents share.

Example: According to the guidelines, Jamie and Alex's basic monthly obligation for their two children is $1,803.

Step 5: Calculate each parent's obligation

If a parent has less than 20% of time-sharing (fewer than 73 overnights a year), work with the basic monthly obligation in this step.

If both parents have at least 20% of time-sharing (73 or more overnights a year), multiply the basic monthly obligation by 1.5. This determines your increased basic monthly obligation, which accounts for the needs of two households. You'll work with that figure in the rest of this step.

Multiply the number (either the basic or increased basic obligation) by one parent's percentage of responsibility from Step 3. This determines how much of the obligation they're responsible for. Repeat for the other parent.

Example: Jamie has the children 20% of the year, and Alex has them 80%. So the parents multiply their basic monthly obligation ($1,803) by 1.5 to get an increased basic obligation of $2,704.

Jamie then multiplies $2,704 by her responsibility percentage (.625), resulting in her monthly obligation of $1,690. Alex is responsible for the remaining $1,014 (37.5%).

Step 6: Adjust monthly obligations for time-sharing

If one parent has less than 20% of time-sharing, skip to Step 7.

Otherwise, multiply each parent's portion of the increased basic obligation (calculated in Step 5) by the other parent's time-sharing percentage. You'll end up with each parent's monthly obligation adjusted for time-sharing.

Example: Jamie multiplies her obligation ($1,690) by Alex's time-sharing percentage (.8, representing 80%), bringing her adjusted obligation to $1,352.

Alex's obligation of $1,014 is multiplied by Jamie's 20% time-sharing (.2), which brings his adjusted obligation to $203.

Step 7: Adjust for child care, medical and dental care expenses

Now, determine the combined total parents pay each month toward child care, medical/dental insurance and other health expenses for the children.

Then, multiply the total by a parent's percentage of responsibility from Step 3 to find how much they should actually be responsible for. If a parent pays more than their share, add the difference to the other parent's obligation.

Example: The children don't have uncovered health expenses. Alex pays $350 per month for day care, and Jamie pays $350 per month for the children's health and dental insurance. Their combined monthly total for these expenses is $700.

Jamie multiplies this by her percentage of financial responsibility (.625) to get $438 — how much she ought to pay toward child care and medical/dental expenses. Alex should be paying the remaining $262.

Since Alex actually pays $350 a month for child care, he is paying more than his share, and Jamie must make up the difference. The $88 discrepancy gets added to her monthly obligation of $1,352 (from Step 6), bringing her final monthly obligation to $1,440.

Alex's obligation remains $203.

Step 8: Determine the monthly payment amount

The parent with the higher obligation pays the other parent monthly. Subtract the smaller figure from the larger figure to find the monthly payment amount.

Example: Jamie subtracts Alex's monthly obligation of $203 from her obligation of $1,440, to get $1,237. This is how much she must pay Alex monthly, according to the state formula.

Alex does not pay Jamie because Florida assumes he meets his spending obligation during his time with the children.

Deviating from the formula

Unlike with many aspects of Florida family law, judges have little discretion when it comes to ordering child support. They can generally only deviate by up to 5% from the award determined by the state formula.

For example, in the scenario above, the judge could order Jamie to pay between $1,175 (5% less than the state formula's $1,237 calculation) and $1,299 (5% more than the state formula's calculation).

Occasionally, judges will order a deviation of more than 5% if a child has special needs or if a parent has extraordinary financial circumstances. The judge must provide a written justification in the support order.

Judges order deviations of their own accord or in response to a parent's Motion to Deviate from Child Support Guidelines.

Department of Revenue (DOR) Child Support Program

The DOR Child Support Program automatically opens its own child support case for divorcing parents who receive public assistance and for unmarried parents who apply for public assistance.

However, if Medicaid is the only public assistance you receive and you want to handle child support through the Department of Revenue, you'll have to open a DOR child support case yourself.

Any parent can opt to get a child support order from the DOR instead of family court if they do not need a divorce or a parental responsibility and time-sharing decision.

If a parent has a case with the DOR and family court, the DOR works with the court to issue a child support order.

When the department issues a support order, it also issues an income deduction order so that payments are deducted from the parent's paychecks and sent to the other parent automatically.

The DOR also assists in enforcing and modifying child support orders.

Getting an accurate child support order

Estimating parenting time can impact your support order by thousands of dollars a year.

Still, lawyers (and even the courts) usually estimate overnights because counting manually is time consuming.

The Custody X Change app lets you quickly calculate your exact parenting time.

Try this with Custody X Change.

With Custody X Change, you can tweak your schedule to see how even little changes affect your time-sharing. And you'll see how your time changes each year due to holidays and other events.

You'll also avoid common math errors, such as counting holiday time as an addition to regular parenting time rather than a replacement.

Whether you're paying or receiving child support, make sure your parenting time calculation is exact. The number that will affect you, your children and the other parent for years to come.