Maryland Child Support Payments

Maryland expects both parents to contribute to their child's care in proportion to how much they earn.

Child support is automatically part of divorce cases. Nondivorcing parents can request child support when they open a custody case, or they can open a child support case.

What's in the child support formula

A formula determines how much each parent should spend. Usually, the parent who sees the child less pays all or part of their share to the other parent as child support.

However, the court can deviate from the formula if parents agree to a payment amount in their settlement, if the child has extraordinary expenses or if the parents' monthly incomes exceed $25,000 when combined.

Maryland's formula takes the following into account. You can plug this information into the calculator above or the appropriate worksheet (linked below) to get an estimated payment. You'll need to turn in a completed worksheet as part of your case.

Parenting time

Consult the child support worksheets. Use Worksheet A for primary physical custody if the noncustodial parent has less than 25 percent of parenting time (fewer than 92 overnight visits per year) in the visitation schedule. If both parents have at least 25 percent of parenting time, use Worksheet B for shared physical custody.

For shared physical custody, the calculation depends on the exact number of overnights the child spends with each parent. The paying parent's obligation grows by:

- 10 percent if they have 92–94 overnights a year

- 8 percent if they have 95–98 overnights

- 6 percent if they have 99–102 overnights

- 4 percent if they have 103–105 overnights

- 2 percent if they have 106–109 overnights

- 0 percent if they have 110 or more overnights

Number of eligible children

Parents can receive support on behalf of their children who are 18 or under (or on behalf of their 19-year-old children still in high school). Each child must be related to the parent biologically or via adoption; stepchildren do not count.

Monthly income

The formula includes each parent's monthly pre-tax income from all sources, including paychecks, tips, bonuses, commissions and rents. Each parent subtracts alimony or child support they already pay, then adds or subtracts alimony payments from the current case.

If a parent is voluntarily unemployed, the court usually enters the minimum wage in the formula. The court may choose not to order child support if a parent is unable to work due to incarceration, hospitalization, rehabilitation or a permanent and total disability.

Child-related expenses

Costs for child care, health insurance and extraordinary medical expenses are calculated into the support obligation. Each parent is expected to pay a share based on their percentage of the combined parental income. If one pays an expense entirely, they receive credit.

Paying child support

Child support is paid monthly.

In some cases, the court orders that support be paid via wage garnishment, and the amount is automatically deducted from the responsible parent's paycheck. If you change jobs, you must ask your new employer to withhold support payments from your check.

You could also pay via another method that provides an official receipt. Acceptable methods include direct deposit and electronic transfer (e.g., Venmo or Zelle). The important thing is to make sure you get credit for the payments. Do not send gifts or give the child money directly — this will not count as child support.

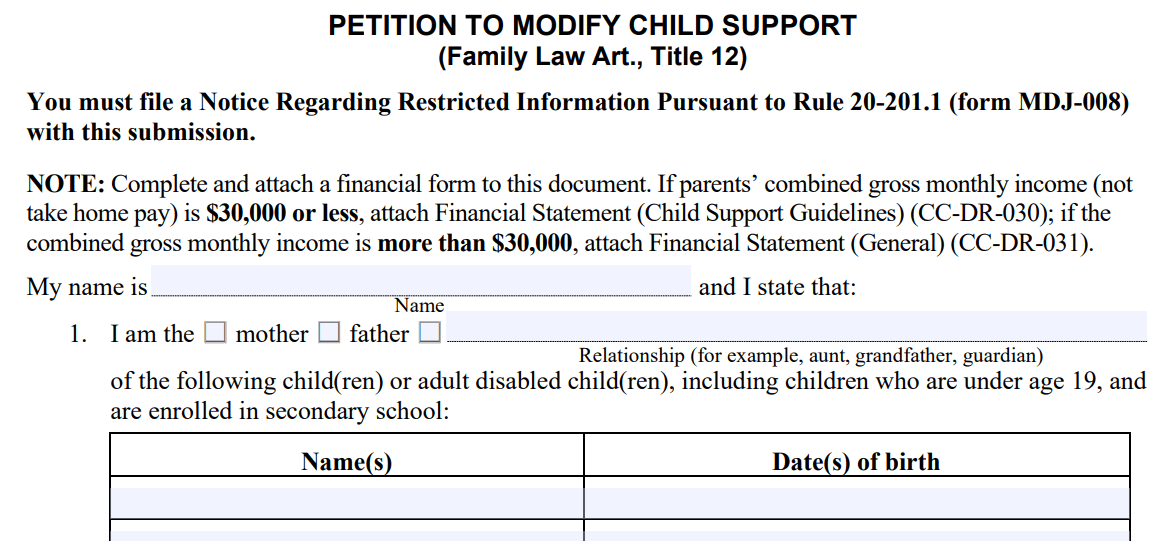

Modifying child support

At any point after receiving a child support order, you can petition the court for a modification. (You'll need to fill out a Financial Statement.)

Alternatively, you can enter a Consent Order if you agree on a new child support amount with the other parent. For either route, you'll need to show that there has been a material change in circumstances.

Material change is not defined by law, but generally anything that causes at least a 25 percent shift in a parent's income or in the child's expenses will count.

You can also ask for a change to your support payment every three years without proving a material change. You'll go through the Office of Child Support Enforcement.

Enforcing a child support order

If a parent misses child support payments, the Office of Child Support Enforcement may take action against them, including suspending their driver's license and intercepting tax refunds.

When a parent routinely fails to pay support, you may need to bring a contempt of court case against them for the judge to enforce child support orders.

Even your child ages out of eligibility while you await payment, all ordered support must be paid.

Getting an accurate child support order

Estimating your parenting time can impact your support order by thousands of dollars a year.

Still, lawyers and the court usually estimate because manually counting overnight visits is time-consuming.

The Custody X Change app lets you quickly calculate your exact number of overnights.

Try this with Custody X Change.

With Custody X Change, you can tweak your access or visitation schedule to see how even little changes affect your number of nights with the child. Plus, you can see how the number changes each year due to holidays and other events.

Whether you're paying or receiving child support, make sure your parenting time calculation is exact. The number will affect you, your child and the other parent for years to come.