Child Support in Manitoba

In Manitoba and the rest of Canada, child support ensures both parents contribute financially to their child's upbringing.

Use the calculator above to estimate the amount of support you'll pay or receive under the official guidelines.

The basics of support in Manitoba

The parent who spends less than 40% of the time with the child pays child support to the parent who has the child in their custody most of the time.

On the other hand, if there's shared parenting time, the parent with the higher income pays support.

Either the court decides the support amount or the parents agree on one. Agreed amounts must be approved by the court, so don't stray too far from what the official guidelines recommend without good reason.

Applying for child support

To request support, fill out the support forms that best suit your case. Email your paperwork to the Child Support Service. There is no fee to file an application.

Modifying child support

You can modify the support amount by written agreement or ask the court to modify your order.

Reasons you may ask for a modification include:

- A decrease in the income of the parent who pays support

- An increase in the income of the parent receiving support

- A change in the parenting arrangement

Enforcing child support

Contact the Maintenance Enforcement Program if a parent misses support payments. They can impose fines and other penalties on a parent who misses payments.

The child support guidelines

Child support guidelines help determine fair support amounts based on each parent's individual income and number of children.

The Manitoba Child Support Guidelines apply if both parents reside in Manitoba and they are not divorcing. The Federal Child Support Guidelines apply if you're divorcing or if the parent paying support lives outside of Manitoba.

The only differences between the two sets of guidelines relate to rules that most parents don't need to worry about. Both guidelines use the same child support table, meaning the basic support obligation will be the same regardless of the guideline that applies to your case.

The court may adjust the final support amount to account for necessary expenses that usually aren't covered by child support, like daycare and extraordinary medical costs.

The court may also adjust support to prevent undue hardship to the paying parent. To qualify, the parent needs to have a legal obligation to support a child from a different relationship, unusually high debts or unusually high costs of exercising parenting time (e.g., travel costs).

The court can order retroactive child support to make up for financial support the child's primary caretaker did not receive before there was a support order.

When do support payments end?

A child support order generally lasts "until further order of the court," so a parent needs to ask the court to terminate it.

However, support orders do occasionally include end dates. Parents can agree on the end date, or the court can assign one.

A court may order support to continue after a child has entered adulthood if they attend university, are unable to care for themselves due to disability, or the parents agree to it.

There isn't a statute of limitations on past-due child support. Repayment of child support arrears may continue even after the support order ends.

Keeping track of payments and expenses

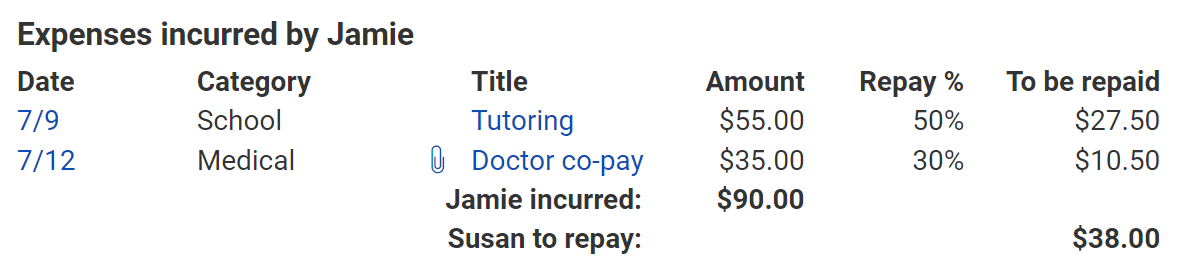

Whether you're paying or receiving child support, the Custody X Change app can help you keep track of support payments and child-related expenses.

Try this with Custody X Change.

Try this with Custody X Change.

Log details of every payment or expense into your parenting expense tracker to ensure you're on time and paid up.

When you're owed money for expenses, share an expense report with the other parent — either digitally or on paper. This is just one way Custody X Change makes co-parenting simpler.