Mississippi Child Support

The noncustodial parent pays child support to ensure they contribute financially to their child's upbringing.

If parents have joint physical custody, no child support is owed unless the parents have a significant difference in incomes and at least one parent's income is low enough to harm the children (educationally, emotionally, etc.). Then the parent with the higher income pays. Support ends once the child turns 21 or is emancipated.

Child support formula

Mississippi's child support guidelines govern how much support parents pay. Use the calculator above or follow the formula outlined in the guidelines to estimate your support amount.

The obligor pays a portion of their adjusted gross income (AGI) — gross income minus taxes and deductions — as monthly child support.

- One child: 14% of AGI

- Two children: 20% of AGI

- Three children: 22% of AGI

- Four children: 24% of AGI

- Five or more children: 26% of AGI

The court might deviate from the guidelines if the obligor's annual AGI is less than $10,000 or more than $100,000.

The cost of the child's health insurance may also factor into the support amount but normally does not.

If there's a significant change in the obligor's income or your child's needs, you may request an adjustment of the support amount. The Mississippi Department of Human Services (MDHS) reviews support every three years for those enrolled in the child support program.

Applying for support

You can ask the court to make a support order when you apply for divorce, child custody or paternity establishment. Or you can file a separate complaint and summons for support.

The state will start a support case for you if you're a single parent applying for public assistance. This will give you access to services provided by the MDHS child support program, including paternity establishment and support order modification and enforcement.

Parents who do not receive public assistance can pay a $25 fee to apply for support through MDHS or to apply just for child support services. They must pay a $35 annual fee to stay in the child support program.

After an application is filed, the court schedules a hearing. You and the other parent will present evidence so the judge can decide the support amount.

If you and the other parent agree on how much support the obligor will pay, you can draft a stipulated agreement or include the information in your parenting plan. Have it notarized and hand in the document to your local Chancery Court. If the court approves it, it will become enforceable like a court order.

Paying and receiving child support

All support payments must go through MDHS.

Obligors can pay child support online or through several other methods.

Obligees can receive support payments via direct deposit or Way2Go Debit Card.

Enforcing child support

Repercussions for not paying child support include suspension of your driver's license and seizure of tax refunds. MDHS will automatically take enforcement actions if it's necessary and you're enrolled in the child support program. Otherwise, start a court action against the obligor.

Orders for child support and child custody are separate. The obligor cannot refuse to pay support because the obligee denied visitation, and the obligee cannot deny visitation because the obligor missed support payments.

Keeping track of payments and expenses

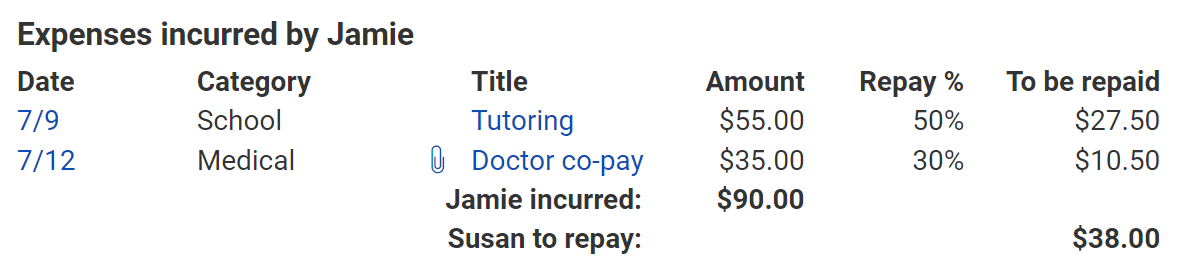

Whether you're a custodial or noncustodial parent, the Custody X Change online app can help you keep track of support payments and child-related expenses.

Try this with Custody X Change.

Try this with Custody X Change.

Log details of every payment or expense into your parenting expense tracker to ensure you have a record. You can upload receipts and other proof.

When you're owed money, share an expense report with the other parent — either digitally or on paper. This is just one way Custody X Change makes co-parenting simpler.