British Columbia Child Support and Parenting Time Totals

Child support ensures parents financially contribute to their child's upbringing. Courts in British Columbia use Canada's federal child support guideline formula to figure out support amounts. Use the calculator above to instantly estimate your support under the guideline.

The parent who spends less time with the child pays support to the other parent. If both parents spend at least 40% of the year with the child, the parent with the higher income pays. To compel a parent to pay support, you'll need a support order or agreement.

Getting a child support order or agreement

You can reach an agreement or go to court to establish support.

To form an agreement, negotiate one-on-one with the other parent or try an alternative dispute resolution method. Child support officers and family justice counsellors staffed in courthouses can also help. You must file your agreement with the court. Upon approval, it becomes enforceable like a court order.

If you can't reach an agreement, you can apply for a support order in either Provincial or Supreme court. Just ask for support when you apply for a family order.

Modifying a child support order or agreement

You can request to change a support order or agreement for many reasons. For example:

- Loss of employment

- Change in the child's needs

- Change in parenting time

You can agree on a change and ask for the court's approval, or you can ask a judge to decide.

Consider enrolling in the Child Support Recalculation Service. This free service reviews support amounts annually to see if changes are necessary. This often helps parents avoid court.

Enforcing a child support order or agreement

The obligor (the parent ordered to pay) must pay support until the child turns 19. They may have to pay longer if the child is disabled or attending university.

The Family Maintenance Enforcement Program oversees the payment and receipt of child support in BC. It can add interest and default fees to late or missed support payments and suspend the obligor's driver's license, among other sanctions. All this is to encourage prompt payment.

Keeping track of payments and expenses

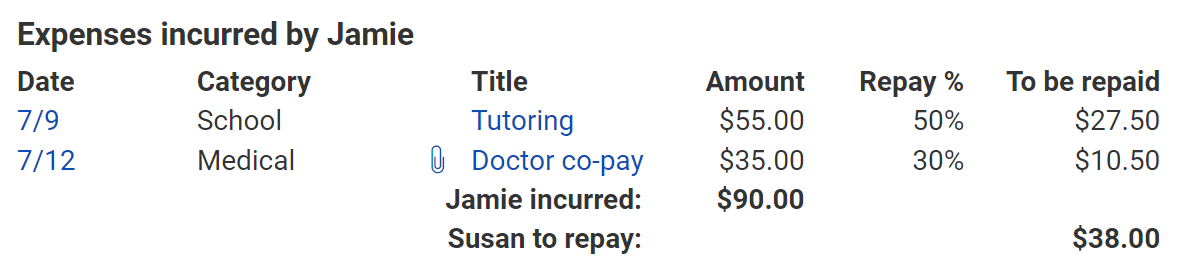

Whether you're paying or receiving child support, the Custody X Change app can help you keep track of support payments and child-related expenses.

Try this with Custody X Change.

Try this with Custody X Change.

Log details of every payment or expense into your parenting expense tracker to ensure you're on time and paid up.

When you're owed money for expenses, share an expense report with the other parent — either digitally or on paper. This is just one way Custody X Change makes co-parenting simpler.