Texas Child Support, Medical Support and Dental Support

In Texas, the noncustodial parent usually pays child support, medical support and dental support to the custodial parent. The noncustodial parent is the one who does not have the right to choose the child's main residence. They can be a joint managing conservator, possessory conservator, or not a conservator at all.

The basics of child support in Texas

If your child has ever received benefits from Medicaid or Temporary Assistance for Needy Families (TANF), the attorney general's office will help set support for your family. The attorney general's process for assigning support is slightly different, but the formula and other details below still apply.

As long as the attorney general is not involved, parents can agree to their own arrangement for child support. If a judge considers the agreement in the child's best interest, they'll approve it. For the best chance of getting a judge to sign off, follow the state's formula or use a neutral professional to draw up your plan (e.g., a mediator).

Whenever you submit a parenting plan to the court — whether it's at the court's request, as evidence in a trial, or as part of a settlement — include the specifics of child, medical and dental support.

Texas child support formula

Child support helps the custodial conservator pay the expenses raising a child entails, such as the costs of housing, food, clothing and child care.

The state issues guidelines for how much a noncustodial parent should pay in child support. Judges nearly always rule in line with the guidelines, but they can rule as they see fit.

The guideline formula does not take into account how much time you spend with your child or whether you're a managing or possessory conservator. In Texas, child support is based only on the noncustodial parent's income and number of children.

If you're a noncustodial parent, use the calculator above to estimate how much child support you owe under state guidelines. Or follow the steps below for a precise calculation.

Step 1: Calculate your monthly net resources

Start with your yearly gross income. This is the money you receive in a year: compensation from your job, unemployment benefits, Social Security retirement or disability payments, alimony, income from investments, net income from rental properties and more.

Yearly gross income does not include your spouse's resources, payments for foster care, Temporary Assistance for Needy Families benefits or Supplemental Security Income.

Note that if you've chosen not to work or to make less money than possible, a judge may calculate your gross income as if you were earning minimum wage for 40 hours a week.

Now, divide your yearly total by 12 to get your average monthly gross income.

Once you have your monthly gross income, subtract the amount you pay each month in:

- Social Security taxes

- Federal income taxes (Use the rate for a single person.)

- State income taxes

- Union dues

- Medical and/or dental support for this child (Scroll down for more information.)

The resulting number reflects your monthly net resources.

Step 2: Determine how many of your children are eligible

A child qualifies for support until they graduate from high school or turn 18 (whichever is later). Children with disabilities may be eligible longer. Children become ineligible if they marry, join the military or are emancipated.

Count how many of your children in this case qualify for support, as well as how many of your other children qualify.

Step 3: Determine the percentage of monthly net resources you will owe

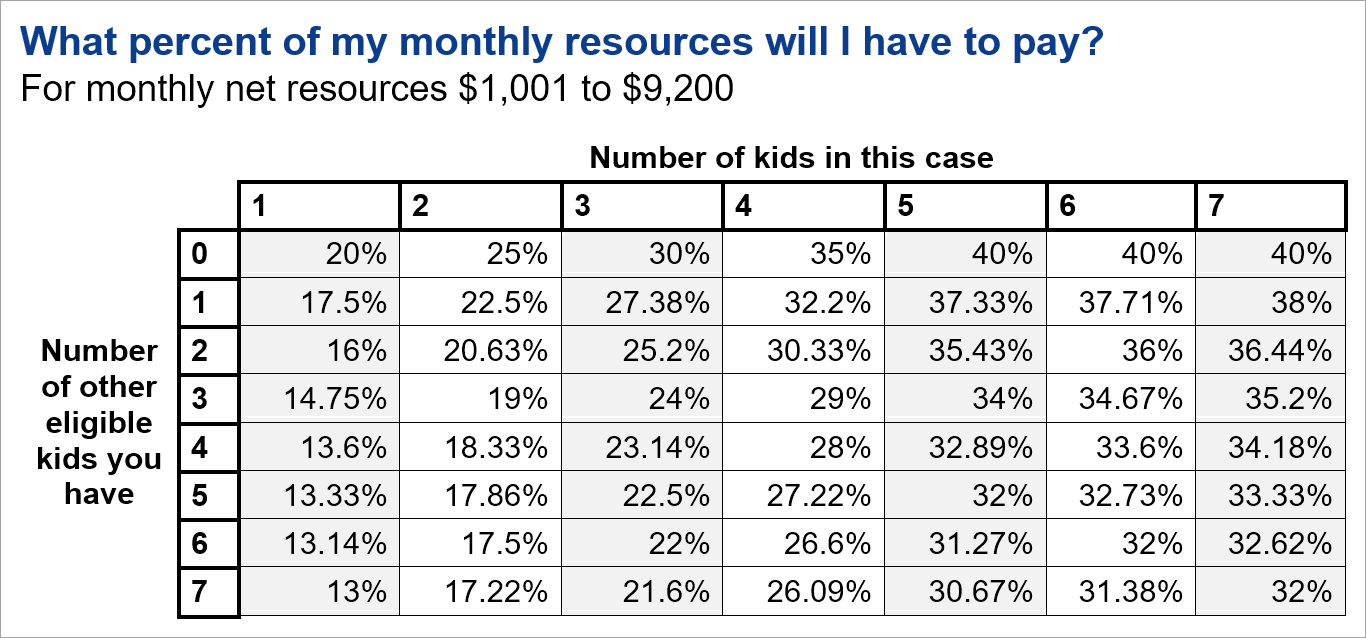

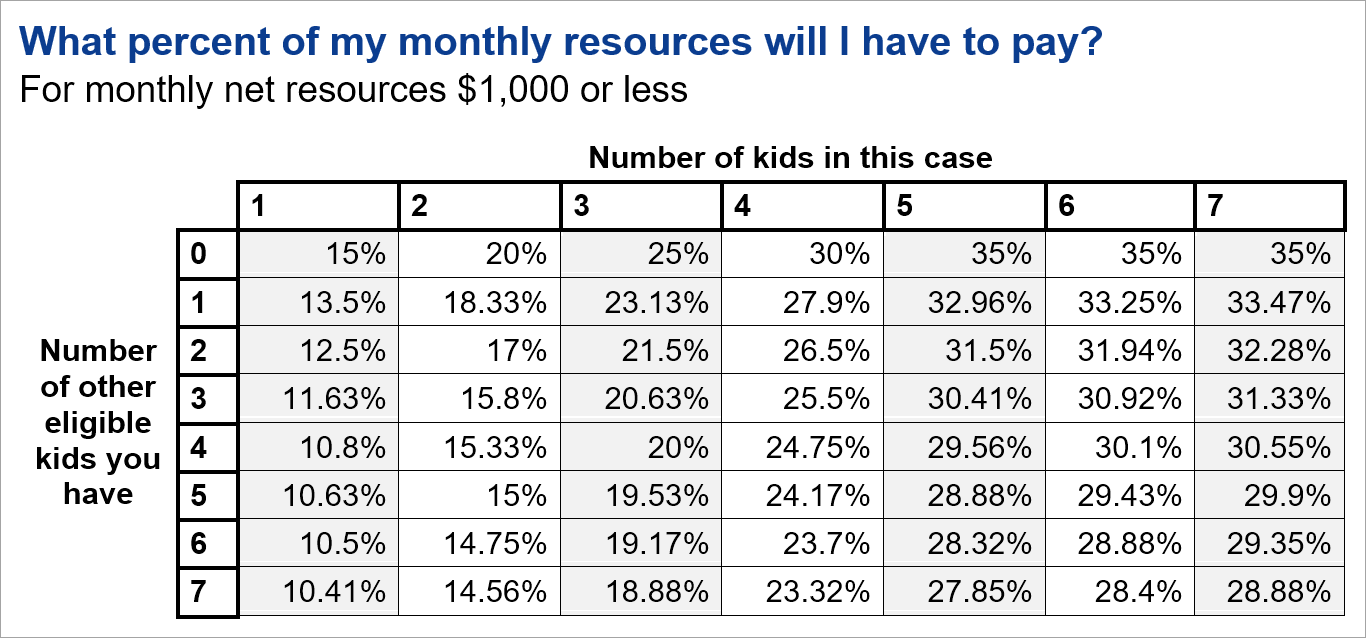

The following chart shows what percent of your monthly net resources you will owe the custodial parent in this case each month. The numbers above each column represent how many children are in this case. The numbers to the left of each row represent the number of other children you have who are eligible for child support.

If your monthly net resources are more than $9,200, only calculate the percentage from $9,200 of your income. The court will essentially ignore the rest of your earnings. However, it may order you to pay additional child support if necessary to cover your child's expenses.

If your net resources are $1,000 a month or less, your percentage will differ. Use the chart below.

Step 4: Apply the percentage to your monthly net resources

Apply the percentage you determined in Step 3 to the monthly net resources you calculated in Step 1.

For example, if your monthly net resources average $4,000, and you have only one child eligible for child support, take 20% of $4,000 to arrive at $800. This is the amount you will pay in child support each month, according to state guidelines.

If your monthly net resources are $1,000, and you have two eligible children in the current suit, as well as two eligible children from another relationship, take 17 % of $1,000 to arrive at $170. This is the amount you'll pay in child support each month to the other parent in this suit, according to state guidelines.

Additional notes on the child support formula

Your monthly child support will change as each child becomes ineligible (e.g., by turning 18 and graduating high school). When this happens, you can predict the new amount you'll owe using the chart above and your updated number of eligible children. Contact your Domestic Relations Office at least 45 days before you make your final payment on a child.

The court doesn't have to make child support due on a monthly basis. A judge can order support paid on a different schedule, in a lump sum, as an annuity purchase or through a property transfer.

In addition, a court can order a parent to pay retroactive child support if the parent didn't live with or help support the child in the past.

The attorney general's office has a child support calculator to help you predict how much support the court will order in your case.

Child support for 50/50 possession

Occasionally — and increasingly — parents agree to equal parenting time in a settlement, so neither one is the custodial conservator. The parents can also agree to a child support structure, subject to a judge's approval.

When judges award this 50/50 possession of their own volition, which they do very infrequently, the question of how to calculate child support becomes more complicated. Several arrangements have been used:

- Sometimes when parents have similar incomes, judges don't order any child support. Medical and dental support are still required by law.

- A judge might order parents to pay for necessities during their possession time (food, housing, etc.) and split the child's other expenses evenly (tuition, extracurricular activities, etc.).

- A judge may calculate what each parent would pay if they were deemed custodial, then order the parent with the higher figure to pay the difference to the parent with the lower figure.

Speak to an attorney to learn how your court usually awards child support in cases with equal possession time.

Medical and dental support

The noncustodial parent pays medical and dental support in addition to child support. These payments are designed to cover the costs of a child's medical and dental insurance.

A young person eligible for child support is also eligible for medical and dental support.

Ordinarily, the parent paying child support is required to provide the child with medical and dental insurance offered by their employer.

If that's not possible, the parent receiving child support is usually ordered to get coverage through an employer. The other parent reimburses the costs (up to 9% of their yearly gross income for medical insurance, and up to 1.5% for dental insurance).

If neither parent can provide insurance, or if the child is covered by Medicaid, the court can order the parent paying child support to give a set dollar amount to the other parent each month.

Typically, each parent pays half of medical and dental costs not covered by insurance. If the parents have drastically different incomes, the judge may order an alternate breakdown.

Parents also have the option to come to their own agreement about who pays for insurance and out-of-pocket expenses, subject to the court's approval.

How to pay child, medical and dental support

When a judge orders support, they sign an Income Withholding Order for Support.

The withholding order goes to the employer of the parent ordered to pay. It tells the employer to withhold a specific amount of money from the parent's paychecks and send that money to the Texas Child Support Disbursement Unit. The unit will then forward the money to the parent owed.

In some cases, parents can agree not to have the withholding order shared with the employer. In that situation, the parent ordered to pay child support must send payments to the Child Support Disbursement Unit.

You cannot pay child, medical or dental support directly to the other parent; it needs to go through the proper channels to be documented.

Modifying Texas child, medical and dental support

You can ask the court to modify the support you're required to pay if there's been a substantial change in circumstances.

You and the other parent cannot agree to a new amount without going to court. The court has to enforce the original support order until it's legally modified or the children become ineligible.

If unpaid support has accumulated, it's a debt called an arrearage, and it can't be reduced (even if both parents would consent to do so).

Enforcing Texas child, medical and dental support

If the other parent doesn't pay child support as ordered, contact the Office of the Attorney General.

Failure to comply with a court order for support can have serious consequences.

Any delinquent child support greater than the monthly amount ordered accrues interest at a rate of 6% per year.

The parent owing money can be found in contempt of court, which can result in up to six months of jail time, a $500 fine per violation, and an order to pay the other parent's legal fees.

If the owing parent receives an inheritance, they must use it to pay the child support arrearage. A judge may also take their federal income tax refund or lottery winnings, order a lien against their property, or suspend their licenses for driving, hunting, fishing or practicing a profession.

If the owing parent doesn't show up to a hearing about delinquent child support, the court can issue a warrant for their arrest.

The court can also place a parent on community supervision for not following orders, which may involve:

- Regular visits to a community supervision officer

- Mediation

- Counseling

- Employment assistance services

Possession versus support

Courts view child, medical and dental support as separate from possession and access.

This means you can't refuse to follow your possession schedule because you haven't received a child support payment. Nor can you refuse to pay child support if the other parent won't let you see the children.

In very special circumstances, a judge may take your possession time into account when deciding how much monthly support to order.

If you can show your possession time far exceeds what is considered standard for a noncustodial parent, you may be able to convince a judge to deviate from support guidelines and order reduced payments.

If your order calls for 50/50 possession, but you aren't actually spending equal time with the child (because splitting a child's schedule perfectly in half is near impossible), knowing what percentage of time you receive can help you present a fair support proposal to the court. There are no support guidelines for cases without a custodial conservator, so an accurate parenting time total may provide a judge with direction.

The easiest way to calculate your exact possession time is to use the Custody X Change online app. Attorneys, judges and parents often rely on estimates because counting parenting time is tedious. But Custody X Change can instantly tell you precisely how much parenting time you receive in a given month, year or period of any length.

Including child, medical and dental support in your parenting plan

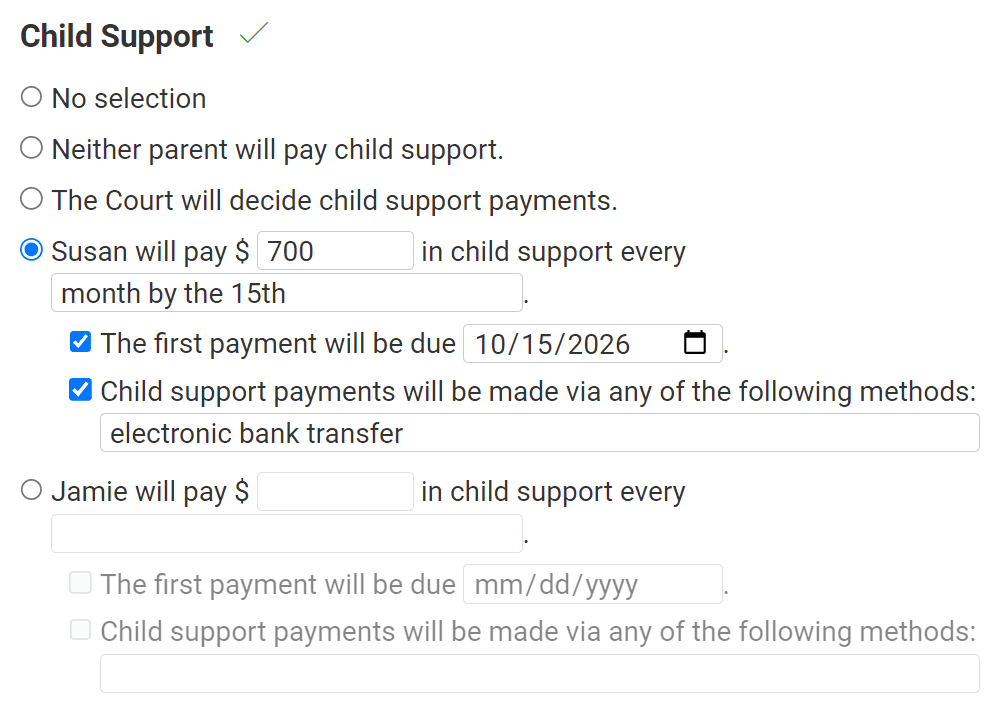

Texas parenting plans must include information on child, medical and dental support.

When you present your plan to the court — either as trial evidence or as part of a settlement — it's critical you use clear language to describe your support arrangements so you avoid confusion and disputes down the line. You must also be careful not to omit any necessary details.

The Custody X Change app walks you through common child support, medical support and dental support provisions so you can choose which to include in your plan.

Try this with Custody X Change.

Try this with Custody X Change.

Developed with family lawyers, the provisions can be customized with your own dollar amounts and percentages. Plus, you can write your own unique provisions.

It's a sure way to get a plan that's tailored to your family AND meets court standards for language, formatting and detail.