Child Support in New York

Child support ensures custodial and noncustodial parents contribute financially to their children's care.

Factors in the New York child support formula

Parents can ask for support when they open a case in family court or supreme court. Alternatively, they can include the details of support in a settlement agreement they draft together.

Large costs ― medical bills, school tuition, day care fees, etc. ― are not covered by child support. Usually, each parent covers an amount proportional to their income.

New York's child support formula considers the following factors. Judges can (but don't often) stray from the formula if a case has unique needs.

Number of overnight visits

The custodial parent receives child support payments ― that is, the parent who has the children for a majority of overnights during the year.

However, if parents split time with the children 50/50, the parent who earns less receives the payments. If parents in a 50/50 arrangement earn the same amount, a judge decides whether child support is necessary.

To count your overnights instantly, taking holidays and special events into account, use the Custody X Change parenting time calculator.

Number of eligible children

Generally, qualifying children must be under 21, unmarried and unemancipated. However, if they have a disability, they may be eligible until they turn 26.

The number of qualifying children from a relationship determines how much of the parents' combined income is considered the family's "basic support obligation."

- 1 child: 17% of combined income

- 2 children: 25% of combined income

- 3 children: 29% of combined income

- 4 children: 31% of combined income

- 5 or more children: at least 35% of combined income

Combined parental income

Income includes wages or salary, unemployment benefits, worker's compensation and Social Security, among other earnings.

The court deducts FICA tax payments, the children's health insurance payments, and child support paid for other children. Then it adds together both parents' resulting numbers to reach their combined parental income.

Parent's percentage of combined parental income

The noncustodial parent's support obligation is proportionate to their percentage of the combined parental income.

For example, if the mother's income makes up 70% of the combined parental income, she's expected to pay 70% of the basic support obligation set by the state.

Special circumstances

You must pay whatever child support the court orders. You can't refuse to pay if the other parent won't let you see your children (and the other parent can't prevent you from seeing your children due to missed payments).

If paying the calculated amount would leave the noncustodial parent below the poverty level or unable to care for other children, the judge will make adjustments.

When the combined parental income exceeds $183,000, the court does not have to apply the child support formula to the entire amount. In these cases, the court usually follows the formula for the first $183,000 of income, then adds additional support based on the custodial parent's ability to provide for the children.

Child support calculation examples

Use the following examples to better understand the New York child support formula, bearing in mind that judges have the discretion to stray from the formula as necessary. You can use the calculator above to get an idea of how much you'll pay or receive.

Example 1

Nicolas and Olivia have two children.

Olivia is the custodial parent, with an annual income of $22,500 after deductions.

Nicolas is the noncustodial parent, with an annual income of $40,000 after deductions.

Their combined annual income is $62,500.

Per the state guidelines for two children (detailed above), their combined annual income is multiplied by .25 (25%). Nicolas and Olivia's combined child support obligation is $15,625 annually.

Nicolas' income is 64% of the combined parental income.

The amount he is expected to pay as the noncustodial parent is calculated by multiplying the combined child support obligation of $15,625 by .64 (64%).

Nicolas must pay Olivia $10,000 annually or $833 per month in child support.

Example 2

Paula and John have four children.

John, the custodial parent, and Paula, the noncustodial parent, have identical annual incomes of $67,500.

Their combined annual income is $135,000.

Per the state guidelines for four children (detailed above), John and Paula multiply their combined income by .31 (31%). The result shows their basic child support obligation is $41,850 annually.

Paula's income is 50% of the combined parental income.

The amount she is expected to pay as the noncustodial parent is calculated by multiplying the combined child support obligation of $41,850 by .50 (50%).

Paula must pay John $20,925 annually or $1,743.75 per month in child support.

Changing child support

Either parent can file an objection if they disagree with a child support order. It must be filed with the court clerk within 30 days of receiving the order in court or within 35 days of the order being mailed.

New York law requires an automatic review of child support orders every two years to account for changes in the cost of living.

Major life changes, such as a job loss, can also make it necessary to modify your child support order.

Modifications are generally handled by family court. Supreme court only deals with child support during active divorce or separation cases.

If you don't have a lawyer, you can petition family court to modify or enforce a support order online. If you do have a lawyer, they'll petition for you.

While you wait to hear whether your request is approved, keep paying as usual. Neglecting to pay can result in jail time and other penalties.

Keeping track of payments and expenses

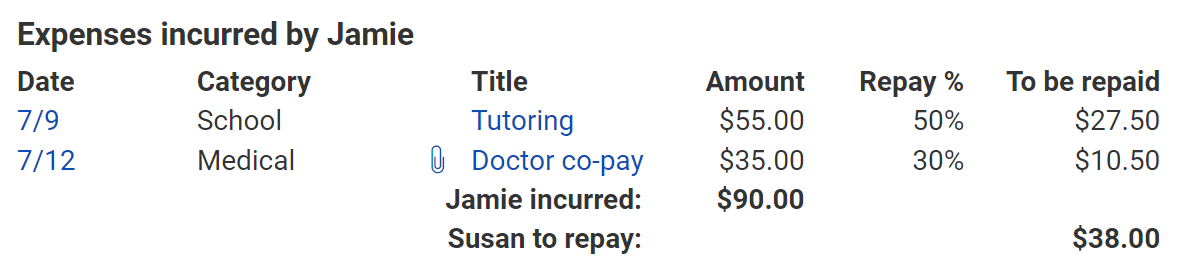

Whether you're a custodial or noncustodial parent, the Custody X Change app can help you keep track of support payments and child-related expenses.

Try this with Custody X Change.

Try this with Custody X Change.

Log details of every payment or expense into your parenting expense tracker to ensure that you're on time and following the court's order.

When you're owed money, share an expense report with the other parent — either digitally or on paper. This is just one way Custody X Change makes co-parenting simpler.