Child support ensures both parents contribute financially to their children's care. Every family law case involving children includes a court order for child support.

A parent cannot refuse to pay child support if the other parent won't let them see their children. Similarly, a parent cannot stop the other parent from seeing their children as a consequence for missing child support payments.

Visualize your schedule. Get a written parenting plan. Calculate your parenting time.

Basics of Ohio child support

In the vast majority of cases, one parent pays child support to the other parent each month until the child graduates high school or turns 19 (whichever happens later).

Usually, the nonresidential parent pays the residential parent. However, if they have nearly equal parenting time, the parent who earns less can petition the other for support, regardless of who's designated as "residential."

For each case, Ohio uses the same formula (outlined below) to determine the guideline child support award — the amount it recommends a parent pay. If a case has unique needs, judicial officers can, but don't often, stray from the guideline award.

To calculate your guideline award officially, use the child support worksheet for sole/shared custody (for most cases) or the child support worksheet for split custody (for rare cases in which each parent has custody of different children).

To estimate your guideline award, follow the steps below, use the calculator above or try Ohio's child support estimator.

The guideline support formula

Step 1: Determine combined annual gross income

First, add up your monthly taxable earnings from wages or salary, unemployment benefits, Social Security and other sources. This is your monthly gross income.

Combine your total with the other parent's monthly gross income and multiply by 12 to determine combined annual gross income.

Example: Consider the hypothetical case of parents Theresa and Sean. Theresa has a monthly gross income of $3,500. Sean has a monthly gross income of $3,000. Their combined annual gross income is $78,000.

Step 2: Estimate combined basic support obligation

Look at the far left column of Ohio's child support calculation chart. Find the range your combined monthly gross income falls within, then look across that row to the column that corresponds with the number of children in your case. That amount is your combined basic support obligation.

Example: Theresa and Sean have two children. The table shows their annual combined basic support obligation is $15,555.

Step 3: Determine your percentage of the combined annual gross income

A parent's support obligation is proportionate to their percentage of the combined annual income. To find this percentage, divide your annual gross income by the combined gross income. Round to two decimal points.

Example: Theresa divides her annual gross earnings of $42,000 by the combined income of $78,000 and gets .54, or 54 percent. Sean divides his annual gross earnings of $36,000 by $78,000 and gets .46, or 46 percent.

Step 4: Calculate your individual basic support obligation

Now multiply the combined basic support obligation (from Step 2) by your percentage of the combined income (from Step 3). Round to the nearest dollar. The result is your individual basic support obligation.

In most cases, the court assumes the residential parent meets their basic support obligation during their time with the children. The nonresidential parent, on the other hand, must pay their obligation to the residential parent.

Example: Theresa multiplies the combined support obligation of $15,555 by .54. She, as the nonresidential parent, pays Sean $8,400 per year, or $700 per month.

Possible: Apply parenting time deduction

In Ohio, the nonresidential parent qualifies for a 10 percent deduction in their support obligation when they have 90 or more overnight visits a year with the children (at least 25 percent of parenting time).

If you don't qualify, skip this step.

If you do qualify, multiply your individual monthly support obligation by .10, then subtract the resulting number from your obligation.

Example: With parenting time every weekend, Theresa qualifies for the deduction. She multiplies her initial support obligation of $700 by .10, then subtracts the resulting amount ($70) from $700. With the deduction, Theresa's payment to Sean is now $630 per month.

Possible: Determine cash medical support

If neither parent has health insurance, the nonresidential parent pays cash medical support to the residential parent, in addition to regular child support. If the children receive Medicaid, the parent pays the state instead. Parents whose children are covered by a private health insurance plan skip this step.

To determine cash medical support, multiply the annual cash medical amount (currently $388.70) by the number of children in this case. Multiply the result by the nonresidential parent's percentage of the combined monthly gross income (from Step 3). Then divide by 12 to get the monthly payment. Round to the nearest dollar.

Finally, if the children don't receive Medicaid, add the total to the nonresidential parent's guideline support obligation.

Example: The annual cash medical obligation for two children is $777.40. With 54 percent of combined income, Theresa's annual obligation is equal to $777.40 times .54, or $420. Her monthly obligation is $35.

In total, Theresa's estimated support payment to Sean is $665 monthly ($630 guideline support obligation plus $35 cash medical support).

Special circumstances

If paying the calculated amount would leave the nonresidential parent below the poverty line or unable to care for their other children, the court will make adjustments.

When parents' combined annual income exceeds $336,000, the court may deviate from the standard child support formula.

If a parent chooses to be unemployed or underpaid, the court may calculate child support based on what they could earn. Factors the court uses to determine this amount include:

- Education level

- Employment history

- Mental and physical abilities

- Average wages and salaries in the area

- Employment opportunities in the area

- The children's ages and unique needs

Applying for child support

Parents with a legal separation, paternity or custody-only case can apply for child support in their paperwork to open a case. A divorce case automatically includes child support.

To decide support separately from another case, file an Application for Child Support Services or, if you receive public assistance, contact your nearest Child Support Enforcement Agency.

Parents with a dissolution case or otherwise settling can name a child support amount they agree on, subject to a judge's approval. To instead ask the court to set the payment amount, parents with a dissolution case would use the forms above.

Modifying child support

Every three years, parents may complete a Request for Administrative Review of Support Order to have their child support adjusted.

If their support order was issued or reviewed less than three years ago, they must prove circumstances that justify a change. Qualifying circumstances include:

- Loss of employment

- Permanent disability that reduces earning ability

- Incarceration or institutionalization

- Change in income of at least 30 percent

- A child becoming ineligible to receive support

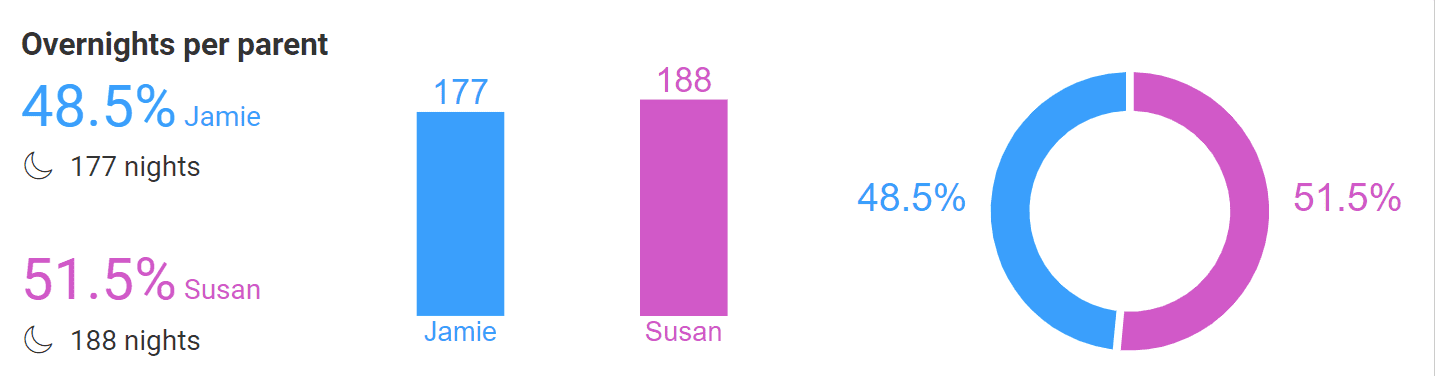

Don't guess or estimate your parenting time percentage

Estimating your parenting time can impact your support order by thousands of dollars a year.

Still, lawyers (and even the courts) usually estimate parenting time because manually calculating it is tedious and time consuming.

The Custody X Change app lets you quickly and accurately calculate your exact parenting time.

With Custody X Change, you can tweak your schedule to see how even little changes affect your timeshare. And you'll see how your parenting time changes each year due to holidays and other events.

Remember that a child support order is legally binding and must be taken seriously. If you fall behind on payments, the Child Support Enforcement Agency could take your income tax refunds. If you simply choose not to pay, a court can find you in contempt and even send you to jail.

Whether you are the one paying or receiving child support, make sure your parenting time calculation is exact. The number will affect you, your children and the other parent. It's not a job for estimation.

Visualize your schedule. Get a written parenting plan. Calculate your parenting time.